On August 1, 2023, Batt Odgerel, Director of Energy Transition Research at Energy Policy Research Foundation, delivered a presentation at the 2023 Annual Conference jointly hosted by the Hawai‛i Asia Pacific Institute (HAPI) and Northeast Asia Economic Forum (NEAEF) in Honolulu, Hawai‛i. His presentation centered on the energy trilemma, encompassing energy security, sustainability, and affordability, within the context of Northeast Asia. Batt Odgerel explored pragmatic avenues to enhance collaboration in the region, taking into account the geopolitical and historical challenges at play.

The 32nd Annual Forum took place August 1-2, 2023, and brought together established professionals in Hawai‘i, North America, and the Asia-Pacific region across the research, business, and government fields to facilitate functional cooperation and tangible partnerships around this year’s theme through presentations, panel discussions, and informal networking and dialogue.

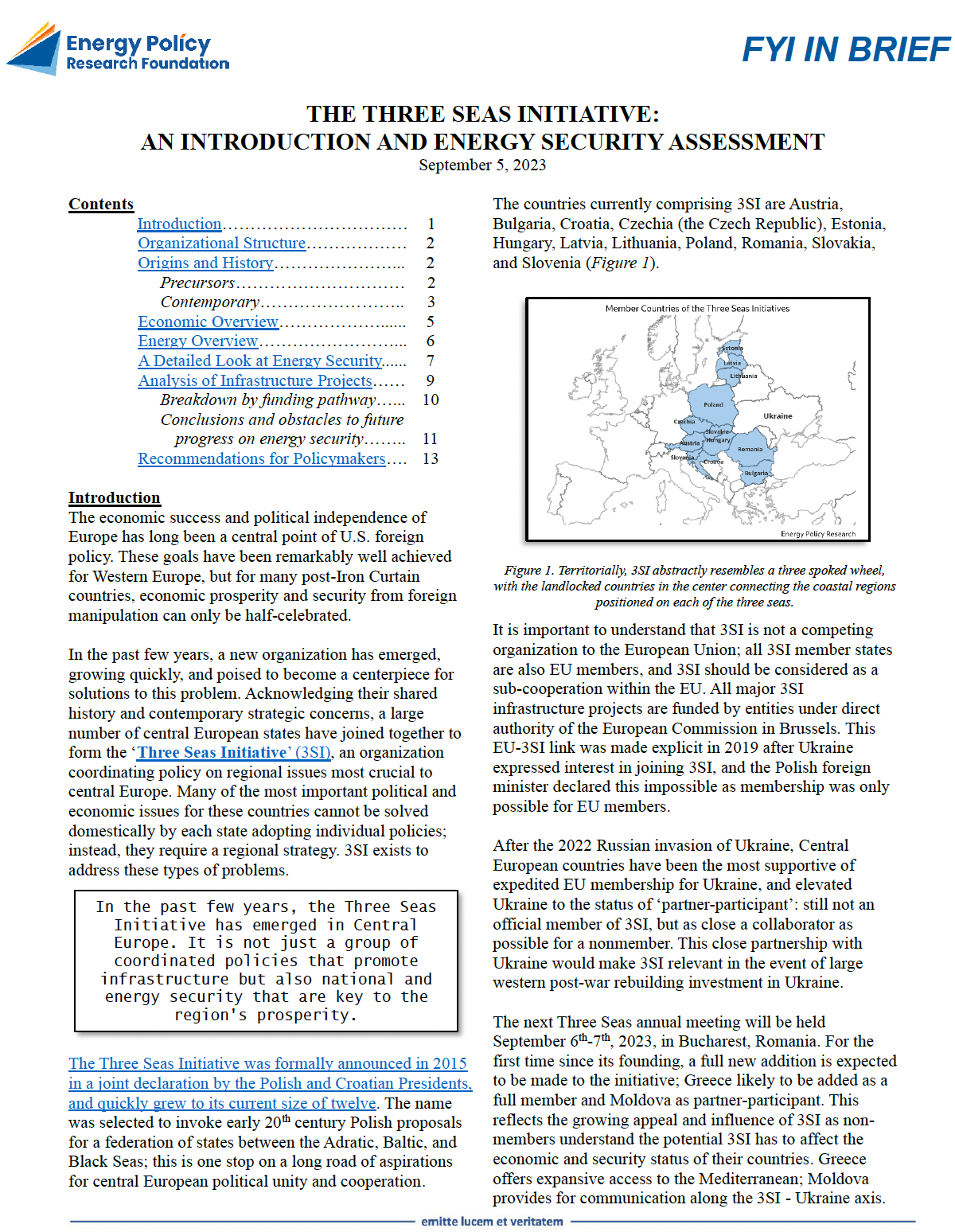

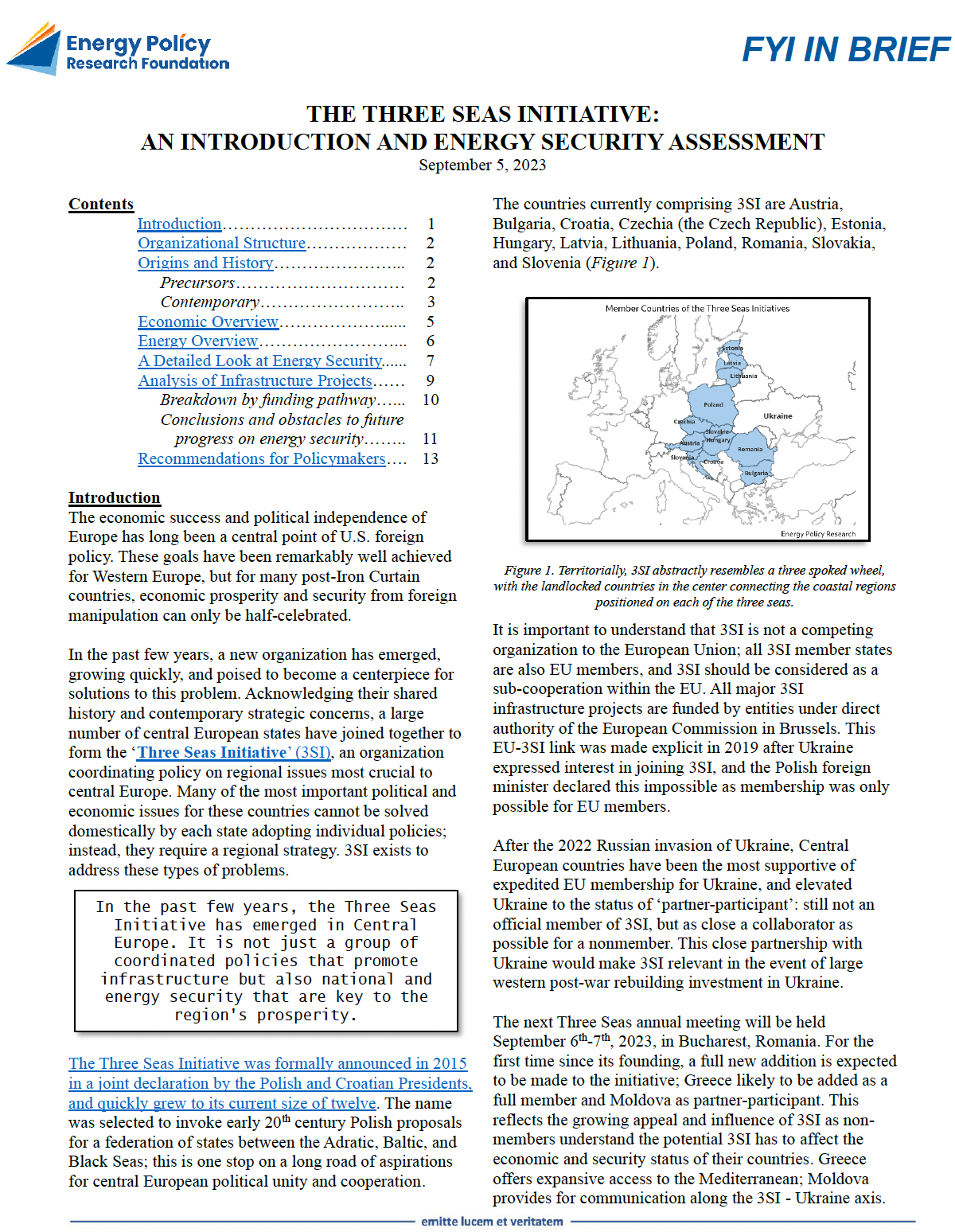

Our popular weekly “Chart of the Week” will now be supplemented with our new “FYI in Brief” series distributed to subscribers and posted on our website at regular intervals. The series is designed as short executive briefings (2-5 pages) providing essential background information on often challenging debates on energy and security policy.

Our first “FYI in Brief” explores the roots and current state of the so-called ESG movement which seeks to evaluate companies’ and related entities’ environment, social, and governance practices. Max Pyziur and Matthew Sawoski bring us a cogent discussion of this topic through their briefing “ESG: A Primer.”

Future topics will include, “Energy Security and the Role of the East Med,” “Eastern Asia-Pacific Energy Security Considerations,” and “Global Mobility Regulations: a Consolidated Source,” among others.

The production of oil and gas from unconventional geologic formations (generally called shale oil and gas) has lifted the U.S. into the world’s largest oil and gas producer. In the midst of the Covid pandemic and the associated worldwide government initiatives to lockdown large segments of the world’s economies, petroleum demand cratered. Analysts, academic researchers, and a large number of commentators viewed the reduction of petroleum demand accompanying the pandemic as a signal that a sustained decline in oil demand had finally arrived. But pandemics have a tendency to return to trend once infections run their course. According to the International Energy Forum (IEF), and referencing the authoritative Joint Organizations Data Initiative (JODI), world oil demand rose in December 2022 (year-over-year) by 1.3 million barrels per day (mb/d). The most recent forecast from the U.S. Energy Information Agency (EIA) points to rising petroleum requirements worldwide. The agency expects global liquid fuels consumption to increase by 1.5 million barrels per day (b/d) in 2023 from 2022 and by an additional 1.8 million b/d in 2024.

So does the U.S. have the capacity to raise domestic oil production to remain an important force in the global market? In this paper, Trisha Curtis, CEO of the PetroNerds consultancy and an EPRINC Distinguished Fellow, takes a deep dive into the unconventional petroleum space and examines its capacity to sustain the U.S. as a world leader in oil and gas production.

The U.S. Senate Budget Committee has jurisdiction over the Congressional Budget Office. In that position, its roles are to draft the U.S. Congress’ annual budget and to monitor that budget’s implementation.

Under the chairmanship of Senator Sheldon Whitehouse (D-RI), the Committee has held five hearings since the 118th U.S. Congress was seated in January. Four of these hearings have focused on the risks and costs of extreme events and weather such rising seas, wildfires, and hurricanes, with the balance on President Biden’s 2024 Fiscal Year Budget Proposal.

Washington Times reporter Sean Salai pursues the Montgomery County, Maryland imminent natural gas ban story. With a population of 1.1 million, Montgomery County is Maryland’s largest county and adjacent Washington, DC. In December 2022 and seeking to mitigate GHG emissions, the County Council unanimously passed legislation to ban natural gas heating in new buildings beginning in 2026.

EPRINC’s Director of Research Programs Max Pyziur comments on the motivation and efficacy of the ruling in the Washington Times Article, here.

On Wednesday, November 9 at noon, EPRINC President Lucian Pugliaresi and EPRINC Fellow Trisha Curtis participated in a Heritage Foundation panel called “What Will Happen to Energy in the Next Congress?” The panel, hosted by Heritage’s Diana Furchtgott-Roth, was described by Heritage as follows:

EPRINC Fellow Tristan Abbey has written this open letter titled “Did Biden Break the Strategic Petroleum Reserve?” The letter was sent on October 27, 2022 to Senators Joe Manchin and John Barrasso, chairman and ranking member, respectively, of the U.S. Senate Committee on Energy and Natural Resources.

EPRINC President Lucian Pugliaresi has co-authored an article published on October 25, 2022 in RealClear Energy entitled “Bad Energy Policy Ideas Never Die“. In it, they discuss their concerns with recent public policies related to energy that have been proven to be major issues that will be difficult to recover from. A quote from the article with their proposed solution is below:

© Energy Policy Research Foundation | 25 Massachusetts Ave NW, Suite 500P (Mailbox 14), Washington, DC 20001 | (202) 944-3339 (Phone) | (202) 364-5316 (fax) | info@eprinc.org

Design & Development by Red Clay Creative