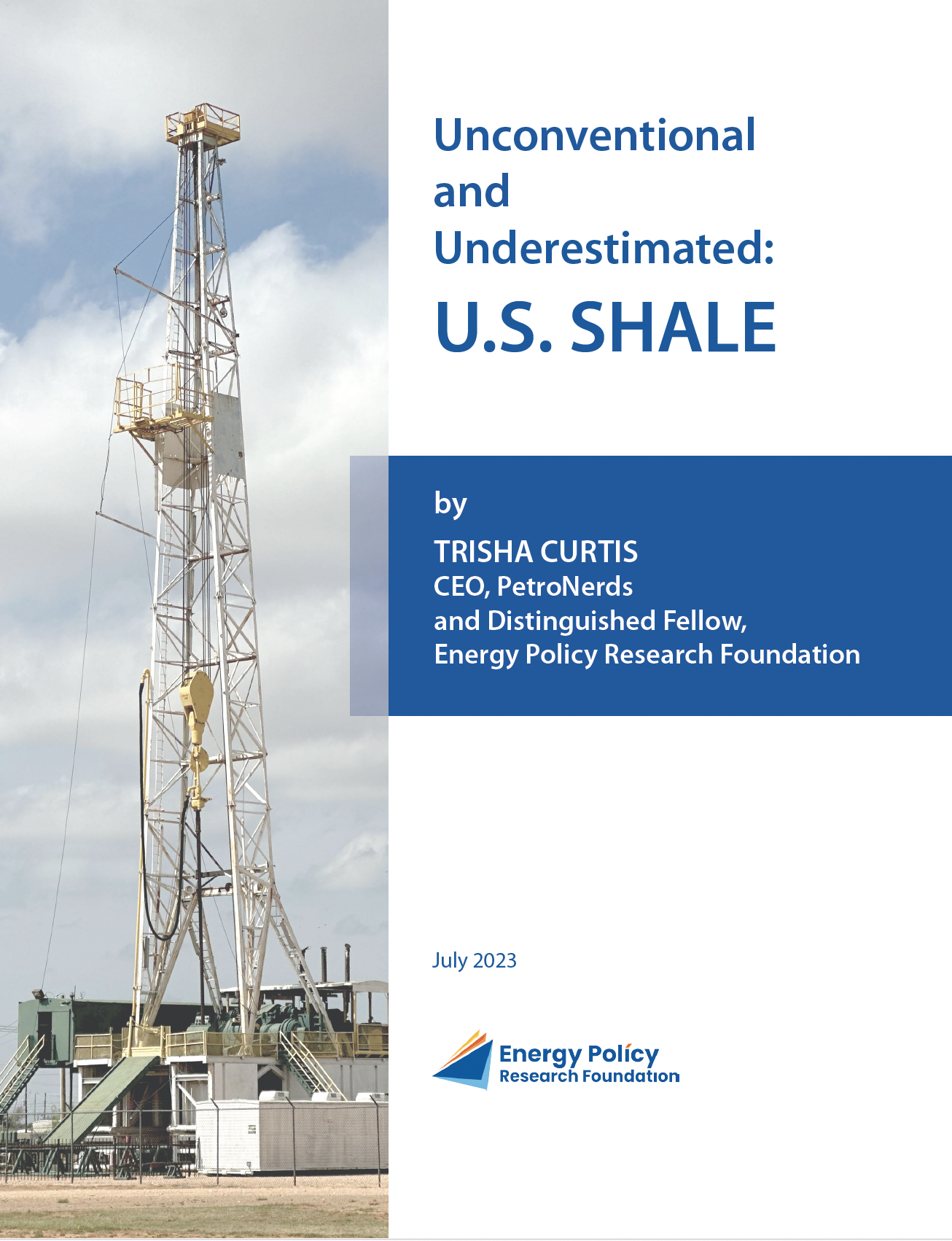

The production of oil and gas from unconventional geologic formations (generally called shale oil and gas) has lifted the U.S. into the world’s largest oil and gas producer. In the midst of the Covid pandemic and the associated worldwide government initiatives to lockdown large segments of the world’s economies, petroleum demand cratered. Analysts, academic researchers, and a large number of commentators viewed the reduction of petroleum demand accompanying the pandemic as a signal that a sustained decline in oil demand had finally arrived. But pandemics have a tendency to return to trend once infections run their course. According to the International Energy Forum (IEF), and referencing the authoritative Joint Organizations Data Initiative (JODI), world oil demand rose in December 2022 (year-over-year) by 1.3 million barrels per day (mb/d). The most recent forecast from the U.S. Energy Information Agency (EIA) points to rising petroleum requirements worldwide. The agency expects global liquid fuels consumption to increase by 1.5 million barrels per day (b/d) in 2023 from 2022 and by an additional 1.8 million b/d in 2024.

So does the U.S. have the capacity to raise domestic oil production to remain an important force in the global market? In this paper, Trisha Curtis, CEO of the PetroNerds consultancy and an EPRINC Distinguished Fellow, takes a deep dive into the unconventional petroleum space and examines its capacity to sustain the U.S. as a world leader in oil and gas production.

We are excited to announce the launch of our report, “A Critical Assessment of the IEA’s Net Zero Scenario, ESG, and the Cessation of Investment in New Oil and Gas Fields.”

In this report, we’ve assessed the likely economic impact of environmental, social, and governance (ESG) with respect to the production and prices of oil and natural gas. This report takes IEA’s major reports—in particular, Net Zero by 2050: A Roadmap for the Global Energy Sector (May 2021) and World Energy Outlook 2022 (WEO-22; October 2022)—on achieving net zero emissions by 2050.

These IEA reports stated:

No fossil fuel exploration is required in the [Net Zero Scenario] as no new oil and natural gas fields are required beyond those that have already been approved for development. (IEA, Net Zero by 2050, p. 160)

In NZE Scenario, declining fossil fuel demand can be met without the need for the development of new oil fields but with continued investment in existing assets. (IEA, World Energy Outlook 2022, p. 326)

These statements have been interpreted by many financial institutions and banks and the media more generally as prohibiting any investment in new oil and gas fields if the net zero target is to be reached. As the world’s economy is heavily dependent on oil and gas supplies and there are no alternatives economically and technologically, rapid and prolonged decline in the production of oil and gas resulting from a lack of investment will have overwhelmingly negative impacts on GDP, national security, and development.

This report examines the feasibility of IEA’s assumptions behind its Net Zero by 2050 (NZE) scenario and its implications for oil and gas production, energy prices, and the global economy and development. In addition to the aforementioned reports, we reviewed other products by IEA: “Energy Technology Perspectives,” “Global Energy and Climate Model,” and “The Role of Critical Minerals in Clean Energy Transitions.”

This work was made possible by the support of the RealClearFoundation. The authors would like to express their gratitude to Rupert Darwall for his invaluable guidance and editing support throughout this project.

While that pipeline could supply China with a cheaper alternative to liquefied natural gas, Xi’s government remains focused on securing diversity of supply — essentially not repeating the European error of excessive reliance on Russia. And there’s a lot of countries seeking to sell gas at the moment, including the US, Qatar, Australia and Turkmenistan, according to Batt Odgerel, a senior research analyst at the Energy Policy Research Foundation, Inc.

“It’s a buyer’s market for China,” he said. “Unless Russia gives an extremely pleasant offer, China can wait as long as it wants. Additional gas from Russia is not required, especially after the lockdown-induced economic downturn.”

© Energy Policy Research Foundation | 25 Massachusetts Ave NW, Suite 500P (Mailbox 14), Washington, DC 20001 | (202) 944-3339 (Phone) | (202) 364-5316 (fax) | info@eprinc.org

Design & Development by Red Clay Creative