Coal production from the PRB can be produced and delivered to Asian markets for approximately $60 per metric ton ($54 per short ton). However, these shipments will not set the price. The U.S. is an infra-marginal coal producer, but the world price is set by higher cost producers whose delivered costs to Asian markets are likely to remain between $90 to $110 per metric ton. As a result, U.S. production will merely replace higher cost production with minimal or no effect on world and U.S. coal prices. Neither net world coal combustion nor GHG emissions will change as a result of an expansion of U.S. coal exports.

The economic value from PRB exports of 50-100 million short tons per year would yield a net economic gain to the national economy between $40 and $60 per short ton, for a total of $2 to $6 billion dollars per year. These are the net benefits to the national economy from exporting low cost PRB coal. Australia and Indonesia are well placed to capture some of this market, but U.S. producers can also capture a substantial volume of this growing market. This net gain to the national economy shows up in higher returns to invested capital, greater employment opportunities from expanded investment, higher revenues to state, local and federal governments, and higher lease values on coal reserves from federal and state lands.

Introduction

In 2010, worldwide production of coal was approximately 7.3 billion metric tons. Of this amount, China produced nearly half. The next largest producer in 2010 was the United States which produced nearly 15 percent of world output. However, with regard to economically recoverable reserves, U.S. coal resources are the largest in the world accounting for more than one fourth of world reserves.

Reduced sales to the electric power sector represent virtually all of the recent loss in domestic coal sales. For U.S. coal producers, a combination of low natural gas prices, more stringent regulatory requirements, warmer weather, and low rates of economic growth are all contributing to substantial reductions in coal consumption in the domestic economy. According to the U.S. Energy Information Administration (U.S. EIA), coal consumption in the power sector is likely to fall to below 900 million short tons by 2012-2013, a level not seen since 1996. As shown in Figure I below, near term projected coal use represents a reduction of over 150 million short tons since the peak consumption for electricity generation in 2007-2008.

Figure I

Annual Consumption for Electricity Generation

(Millions of Short Tons)

Source: Energy Information Administration

Electric power generation is by far the largest end use for American coal output, accounting for 92% of all domestic coal combustion. The remaining domestic sales for coal in the U.S. are for a range of industrial uses, including the production of pig iron, which is made through the combustion of metallurgical coal in a process known as coking. Coal use for domestic coking plants and all other industrial uses outside of large electric power generating facilities has been limited in recent years, amounting to no more than 60,000 to 70,000 short tons since 2009, or approximately six to seven percent of U.S. coal consumption. As shown in Figure II, coke plants, commercial and institutional uses, and all other industrial uses represent a small and relatively stagnant segment of the U.S. coal market.

FIGURE II

U.S. Coal Use by End-Use Sector, 2005-2011

(Thousands of Short Tons)

Source: Energy Information Administration

Export and Import Markets

The United States exported a total of 107 million short tons of coal in 2011, up 31% from the year before and the most since 1991. Export sales have historically been dominated by metallurgical coal sales (70 million short tons in 2011), but steam coal sales are on the rise. Exports of steam coal, used mainly to fuel power plants, were an estimated 37 million short tons in 2011, the highest since 2008. Coal exports have been an important source of revenue for U.S. coal companies as they adjust to declining demand in the United States. Trends in coal export and import sales are shown in Figure III.

FIGURE III

U.S. Coal Exports and Imports

(Thousands of Short Tons, Monthly Data)

Source: Energy Information Administration

U.S. coal exports are moving towards markets with higher rates of economic growth. Coal exports to European and Asian markets represented 76% of total U.S. coal exports in 2011. While European markets have traditionally received a significant portion of U.S. coal exports, note, as shown in Figure IV, that the share of coal exported to Asian markets is up since 2009 because of growth in sales to South Korea, China, and India. In 2011, total annual coal exports were up 31% compared to 2010, reaching 107 million short tons, due largely to rising exports to Europe and Asia.

FIGURE IV

U.S. Coal Export Destinations, 2001-2011

(Millions of Short Tons)

Source: Energy Information Administration

Source: Energy Information Administration

Several major factors contributed to the rise of U.S. coal exports in 2011 in addition to rising demand from Asia. Falling domestic coal consumption (down 4.6% in 2011) along with a slight increase in U.S. coal production (0.9%) freed up more coal to export. A series of international coal supply disruptions in 2011 in traditional supply areas such as Australia, Indonesia, and Colombia meant that Asian countries needed to secure coal supplies from alternative markets.

Demand and Price Outlook

A more important feature of the coal market is the rising longer term value of steam coal in the world market. As shown in Figure V below, steam coal prices in Asia have sustained prices above $100 in Japan since 2008, and over $120 in Europe in 2011.

FIGURE V

Recent Trends in Metallurgical and Steam Coal Prices, Europe and Japan

Source: ICE futures as of 6/15/2012.

Although the surge in U.S. natural gas production from the shale gas “revolution,” combined with new environmental regulations are limiting growth in coal’s use for domestic power generation, worldwide steam coal demand is rising. Research from the International Energy Agency forecasts world demand for steam coal to rise by over 1 billion metric tons in 2016 from 2010 consumption levels. IEA’s growth forecast and recent history in steam coal demand is shown in Figure VI below.

Figure VI

Steam Coal Demand to 2016

(Millions of Metric Tons)

Source: International Energy Agency, Medium-Term Coal Market Report 2011

Futures prices are confirming expectations among buyers and sellers on continued growth in coal demand and that the medium term outlook remains bullish for steam coal prices. As shown in Figure VII below, futures contracts in Rotterdam, Richards Bay (Australia), and Newcastle all show rising values for steam coal through 2016.

Figure VII

Coal Futures Prices through 2016

(Millions of Metric Tons)

Source: ICE futures as of 6/15/2012

This longer term higher value for steam coal reflects not only growth in electricity generation in Asian markets, but coal’s cost advantage over other fuels in the region. As shown in Figure IX, even though there has been large scale expansion of natural gas production in the U.S., the cost of liquefaction and transportation to Asian markets brings landed prices for natural gas (on a BTU basis) substantially higher than delivered prices for Australian and U.S. coal.

U.S. coal production from the vast reserves in the Powder River Basin (PRB) in Montana and Wyoming are very competitive and can be delivered to major Asian markets at prices below many Australian competitors. Although U.S. demand growth for coal is likely to remain stagnant or perhaps decline for the near-future, low cost and plentiful supply from the PRB continues to make it an attractive fuel for electricity generation in much of the world, particularly throughout Asia.

Recognition of the value of federally owned PRB coal can be seen in a recent lease sale held in Wyoming where the winning bidder (Peabody Coal) paid nearly $800 million to the U.S. Government for the rights to expand an existing mine and maintain their current workforce in Wyoming. According to data from the Bureau of Land Management, 13 active coal mines in the Wyoming portion of the Powder River Basin alone employ over 6800 workers.

FIGURE VIII

Coal Maintains a Cost Advantage in the Global Energy Market

(Asian Energy Import Prices, $ per million btu’s, 2012)

Source: FERC, Bloomberg, Cheniere, Data as of 6/15/2012

Economic Value and Environmental Concerns from American Coal Exports

The world coal market is now experiencing both rising demand and higher prices for steam coal. The sustained growth in world demand for steam coal can provide large net economic benefits to the national economy of the United States. This is because the U.S. has a large endowment of low-cost, high quality coal reserves that can be competitively shipped to high value destinations through rail and seaborne transport. According to the International Energy Agency, by 2016 coal demand in Asia is likely to increase by well over 150 million metric tons above 2011 levels. Australia and Indonesia are well placed to capture some of this market, but U.S. producers can also capture a substantial volume of this growing market.

Proposed port construction and expansions in Cherry Point, Long View, and Hoquiam, Washington and other ports in Oregon offer the potential to expand total export capacity to well over 100 million metric tons. Clearly, all of these facilities may not be constructed, but interest in expanding and/or rehabilitating these port facilities point to Asia as the high valued destination for U.S. coal exports.

Environmental groups have raised objections in two categories to port expansions and higher volumes of U.S. coal exports. The first is concern over rail traffic, congestion in scenic areas, and potentially higher volumes of coal dust. These tend to be state and local concerns which can be addressed through a number of remedies. The second concern often raised is that the U.S. should not be encouraging or even permitting U.S. coal exports because such exports will lead to greater worldwide coal combustion (through higher export volumes and lower coal prices). The resulting higher volumes of coal use would then lead to greater emissions of greenhouse gas emissions (carbon dioxide) and harm efforts to control global warming.

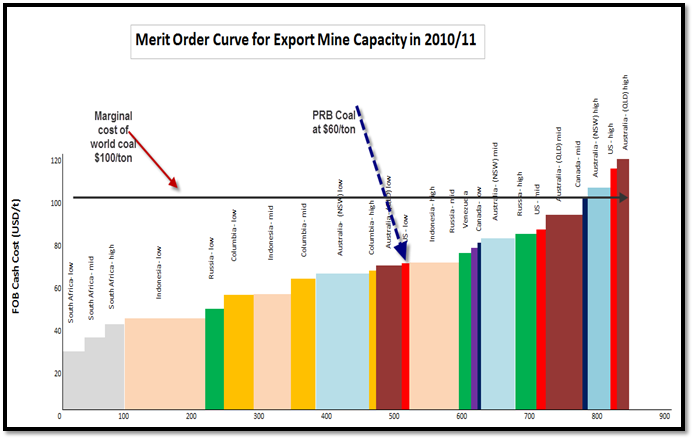

Concern over the potential of U.S. exports to produce a net increase in emissions of GHGs is misplaced because of the nature of the world supply curve for coal production, also known as the “Merit Order Curve.” The Merit Order Curve shows the cash cost of producing and delivering steam coal to major Asian markets. As shown in Figure IX below, the U.S. is a relatively low cost producer including rail and shipment costs to Asian destinations. Coal production from the PRB can be produced and delivered to Asian markets for approximately $60 per metric ton ($54 per short ton). However, these shipments will not set the price. The U.S. is an infra-marginal coal producer, but the world price is set by the marginal producer which is likely to remain between $90 to $110 per metric ton. As a result, U.S. production will merely replace higher cost production with minimal or no effect on world coal prices. Neither net world coal combustion nor GHG emissions will change as a result of an expansion of U.S. coal exports.

Figure IX

Source: Energy Information Administration, Macquarie, EPRINC calculations.

The economic value from PRB exports of 50-100 million short tons per year would yield a net economic gain to the national economy between $40 and $60 per short ton, for a total of $2 to $6 billion dollars per year. These are the net benefits to the national economy from exporting low cost PRB coal. We measure the economic benefits in this manner because real goods and services to produce and deliver the commodity to foreign destinations is substantially below its value in the world market. The higher net value received is in effect a wealth transfer from foreign consumers to U.S. producers and the national economy. This net gain to the national economy shows up in higher returns to invested capital, greater employment opportunities from expanded investment, higher revenues to state, local and federal governments, and higher lease values on coal reserves from federal and state lands.