In December 2009, the government of Iraq held a competitive auction for the rights to develop 60 billion barrels (bbls) of proven crude oil reserves across 10 major fields. The output requirements under the awarded contracts yield a production plateau of 9.6 mm b/d by 2017 in addition to current production. By any standard the Iraqi auction represents a major event in the history of the world oil market – it is the largest single transfer of petroleum reserves into the production stream of the oil market since the beginning of the petroleum era. Iraq’s proven reserves are estimated at 115 billion barrels which ranks the country third in proven reserves behind Saudi Arabia and Iran. However, credible estimates of Iraqi reserves suggest Iraq contains over 200 billion barrels of recoverable reserves and potential resources of over 400 billion barrels.

The production commitments for these reserves among the winning bidders, through a contracting vehicle called technical service contracts (TSC), are only partially transparent. It is known that companies will receive a fee of $1-$2/bbl plus cost recovery of incurred capital, operational and supplementary expenditures.

International oil companies have said that the Iraqi contracts provide them with double digit returns of approximately 15 percent. Although such returns might also be available from other projects in company project portfolios with lower risk profiles, the IOCs likely view Iraq as also providing an opportunity to substantially improve returns through access to new ventures. The Iraqi government expects to receive over 95% of total revenues generated by the auctioned fields. This has already diffused early political opposition to the auctions as proposed. There are important unknown aspects of the contracts, such as the ability to renegotiate fees for both contracted and newly discovered reserves and how cost

efficiency is rewarded under the contracts. There has been no mention of the mechanism to accommodate any possible conflict on the government’s contractual commitment to the companies should Iraq curtail national production in concert with OPEC. Also unresolved is the issue of responsibility for making massive logistical and infrastructure investments required to produce such large volumes of crude in the next six to seven years.

Admittedly, a large array of external and internal threats and more traditional obstacles could derail Iraq’s prospects for a massive increase in crude oil output. Nevertheless, the prospect that Iraq could potentially bring about a “supply shock” to world oil supplies can no longer be dismissed out of hand. An alternative view is that expanded Iraqi production may provide essential new supplies to prevent a “price shock” if non-OPEC production experiences sustained output declines. In this scenario the role of Iraqi supplies may be more as a brake on rising prices rather than a catalyst to a lower price path. In any case, the Iraqi auction clearly opens the door for a careful review of the conventional wisdom on the outlook for oil prices over the next 20 years.

Potential Production Profiles

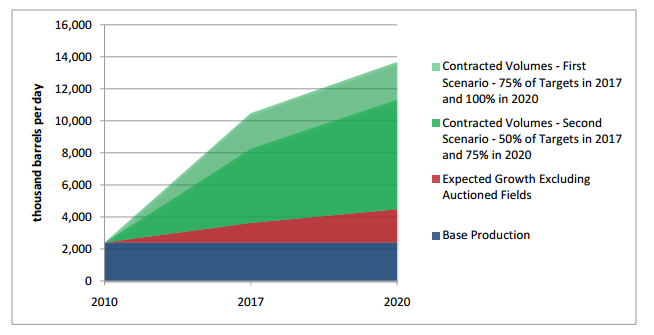

Table I below outlines Iraqi production growth under two scenarios.

Figure 1. Iraqi Production Under Two Scenarios*

*9.6 mm b/d are contracted to come online by 2017 in addition to current production of roughly 2.4 mm b/d, bringing total Iraqi production to 12 mm b/d in 2017 – equal to Iraq Oil Ministry expectations. However, EPRINC anticipates delays and has built them into its production estimates found in Figure 1 above. The first scenario assumes contracted plateau volumes are delayed until 2020 rather than the contracted date of 2017 and in the second scenario only 75% of contracted volumes are available by 2020. Source: Iraq Oil Ministry, EPRINC calculations and estimates.

The scenarios outlined in Figure 1 clearly raise the potential for downward price adjustments in crude oil against a range of business as usual cases. Even a relatively modest shift in long run prices would provide enormous benefits to the U.S. economy. A sustained decline in oil prices of just $20/bbl (from any likely forecast level) would confer present value savings for the U.S. economy of over $1 trillion – a large sum even by current standards. Because the potential for lower oil prices from new Iraqi production is substantial, several of the likely price outcomes may also place alternative transportation fuels into severe financial stress. Biofuels, for example, which face marginal economics even at oil prices in the range of $80/bbl, will require additional subsidies at lower oil prices which may not be easily obtained in an era of “fiscal fatigue.”

The Auction

Over 40 companies were prequalified for the auction’s first round in mid 2009. The initial auction did not go well. It was clear that the government and the companies had widely different perceptions of the value of the contracts. Only one of eight fields reached a contracted agreement in the first round, and only after a 50 percent increase in the price of the bid. Several months following the first round, Iraqi policy changed dramatically. Failed bids on two supergiant fields in the first round were adjusted and accepted. As it turned out the bids on those fields set the price that prevailed in the second round. It is clear that there were adjustments in contractual terms after the first round, but that change has never been acknowledged. There have been references to a substantial change in the method of applying the income tax. That change is large, but does not fully explain the willingness of all companies to increase the effective price paid by well over 50 percent.

A second development occurred at the revision of the two first round bids. The bidding companies increased the volumes for which they bid. This occurred despite the low weighting of volume (20%) versus other criteria in the auction process. The Iraqi government evaluates each company’s bid using criteria which include production fees, production volumes and production timeframes. By increasing proposed production volumes in their bids and lowering their per barrel production fee, the companies’ bids became immensely more valuable to the Iraqis. It provides the government with a larger take per barrel of production, but perhaps more significantly the increase in plateau production volumes (an increase of 5 mm b/d from before the auction began to the time they were completed) provides an enormous boost to Iraqi revenues in a very short time period. This change explains the sudden (and somewhat problematic) jump in the ministry’s forecast of peak plateau volumes. The higher plateau level of 12 mm b/d is highly optimistic, but it is well to remember that achieving those volumes on a stipulated timetable is contractual.

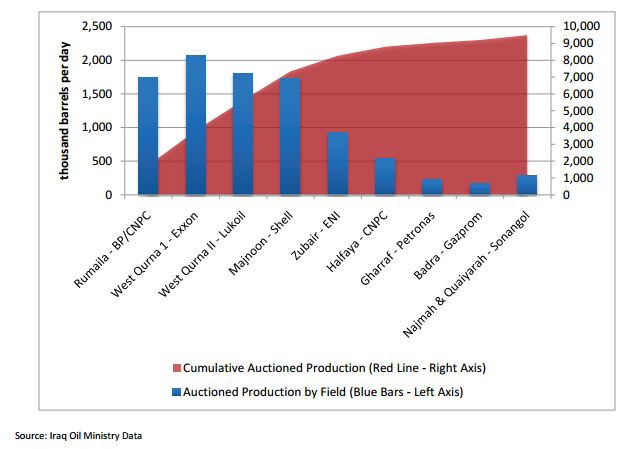

Figure II below shows the production commitments by field from the winning bids.

Figure 2. Auctioned Production at Peak by Field and Cumulatively

After the Auction

News from the winning consortia has focused on overall capital spending budgets (which were part of each field’s contract) and, in some cases, the contracts included an estimate of the number of expected wells drilled and volume of rig tenders. Although planning is the primary job required in the first year for developing these projects, organizing the drilling program will be given a high priority in bringing field production to a higher level. Appraisal and seismic work will take place ahead of most of the drilling and professionals in those areas are already in Iraq.

Anticipated Difficulties – and Some Possible Solutions

The unprecedented scale of the commitment of the Iraqi government combined with long and sophisticated experience in project management among many of the winning bidders offers considerable potential for the field development effort to move forward quickly. Some of the difficult political issues have been met in the auction decision and process; others are being met, if grudgingly, by the very large and unexpected revenues which will be distributed to all Iraqi provinces on an equal per capita basis. The pitched rhetoric between the Kurdish government and the central government has softened, but substantial areas of disagreement remain. In line with their historical pursuit of autonomy, the Kurds have initiated and want to pursue a separate energy enclave. Under the proposed revenue distribution structure from the central government, the Kurdish government would receive 17 percent. It would be a great deal of money, much greater than the Kurds are likely to achieve from their regional oil development program.

Security issues are also political issues. It is agreed that violence has been sharply reduced in the past three years, but it remains high and unacceptable. Ongoing attacks are centered in the Baghdad area and to its North. Fields there, including the two supergiant fields of Kirkuk and East Baghdad never received acceptable bids. Nearly all of the fields that will be developed are in southern Iraq. The companies have not been deterred by security concerns there, though some may exist.

Managing and developing new infrastructure is the greatest challenge. Bottlenecks are certain to occur. Delays in obtaining rigs will no doubt be a problem. Developing a system for bringing water from the Gulf for secondary recovery operation will require a very large common effort by the companies. Much of the infrastructure will be centered on the fields where its costs will be recoverable as production is increased. The government has charged itself with repairing and expanding Iraq’s existing oil pipeline system and its oil ports. Large engineering contracts have been let to upgrade and expand Iraq’s oil ports in the Gulf. That process will need to continue as large volumes of oil will need export facilities in just three years. The costs of pipelines and ports are high and the government’s record on timely processing of payments is not exemplary. It remains to be seen if that process moves along at a sufficient pace.

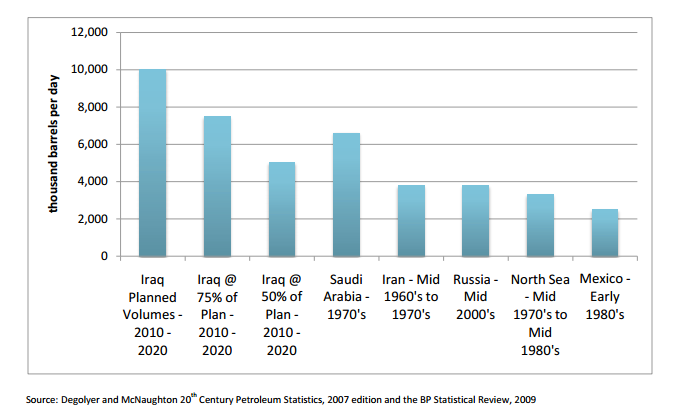

Beyond its enormous scale (more than 60 billion barrels of oil contracted for development), the auction breaks new ground in two crucial ways. It is the first time in the history of the industry that so many development projects of this size will be initiated at the same time (with target completion dates at the same time). As shown in Figure III below, the Iraqi auctions, if they meet all of or three quarters of the contracted volumes, will surpass even Saudi Arabia’s massive production expansion of the 1970′s.

Figure 3. Largest Historical 10 Year Incremental Crude Oil Production Increases

The auction represents the first significant break from the prevailing oil industry structure in almost 40 years. From the time of wide scale nationalization of the major oil companies in the 1970's, oil companies have had limited ability to explore for or develop oil reserves in those countries. This has been especially true in the Middle East Gulf region where the world's largest reserves are located. The Iraqi auction will stand as an action that marries the interests of oil companies and of a government which controls a very large reserve base. Large multi-national oil companies can often bring a unique set of technical skills and efficiency in managing large scale and complex oil field development projects (and the capital needed to do so). Iraq has large reserves and a great need for revenue. With its action Iraq has established a format for reserves development which leapfrogs the models of the other major Gulf oil producers – a transparent contractual arrangement that offers international companies an acceptable return on investment.

History

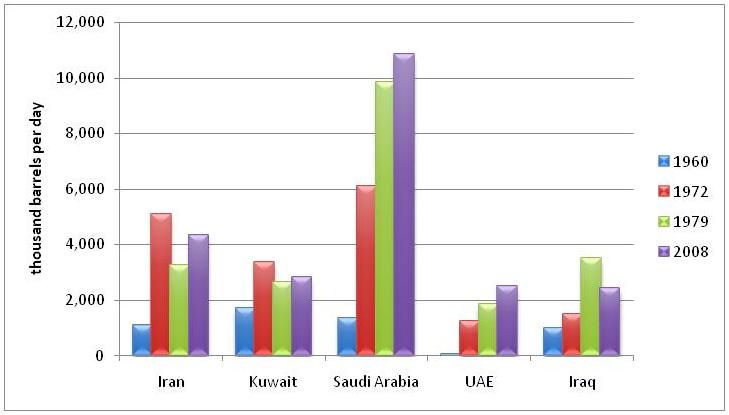

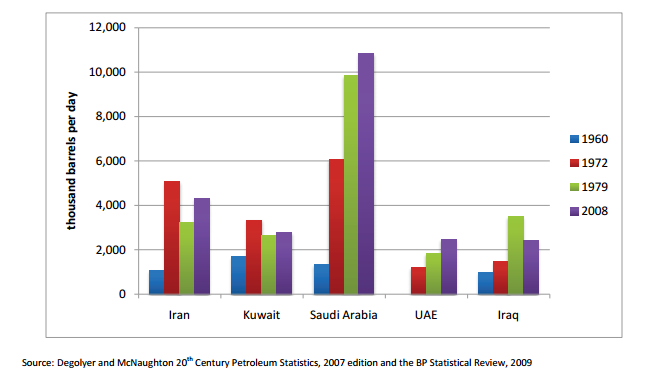

Iraq’s oil industry has been arguably the most constrained in the world. In the sixty years preceding the auctions, the Iraqi oil industry had functioned successfully for only seven years. It was owned and operated from the late 1920′s until its nationalization in 1972 by the Iraq Petroleum Company, a consortium of four international oil companies. The preferences of some of these companies to increase production in other international concessions led to an artificially slow development of Iraqi oil. From the end of World War II until 1972, Iraq produced at only half the rate of Kuwait, Saudi Arabia and Iran. In the seven years following nationalization, Iraq’s national oil company was able to increase production from 1.4 mm b/d to 3.5, a pace twice as fast as Saudi Arabia.

Figure 4. Middle Eastern Crude Production in Selected Countries

The ascendancy of Saddam Hussein’s regime led to a succession of international conflicts which capped further growth of the industry. This continued through the US invasion and occupation of Iraq. During the past several years, the emergence of an Iraqi government did not alleviate the industry’s endemic problems – reservoir damage in its two largest producing fields, a severe shortage of required equipment and the inability of the government to fund the purchase of needed equipment and expertise.

The Rebirth of Iraqi Oil

There has been a strong determination and leadership among the country’s oil elite to push Iraqi oil toward a major expansion. Planning for renewed investment and the achievement of higher production began as the regime of Saddam Hussein ended, well before there was any clarity about the political future of Iraq. Senior Iraqi oil executives knew the size of their reserves base and understood what actions were necessary. They wrote of the desirability and the need to invite major oil companies to spearhead this effort. For the following six years, the effort to establish a well thought out politically acceptable oil policy moved ahead, but with substantial difficulty.

The elections of 2006 led to the appointment of a politically respected oil minister and a priority of the government to write and pass an oil law which would underpin aggressive steps to jumpstart the industry. A draft law was written, but it has not had the approval of the parliament primarily due to Kurdish objections on the content and structure of the proposed law. By early 2009, a decision was reached within the government to proceed with a broad and aggressive oil auction. This entailed writing detailed contracts that would be dependent on the 2005 constitution and an oil law from the Saddam Hussein era.

Oil Companies

Most of the companies who hold substantial positions arising from the auction are (1) very large and (2) have had quiet roles of participation in Iraq’s oil industry. Predecessors to LUKOIL and Total had significant roles in Iraq as far back as the late 1960′s. The Chinese state company CNPC began work on an Iraqi oil field in 1997. Many of the international oil companies (IOCs) have provided technical assistance on Iraq’s largest producing fields, and have brought Iraqis to their home facilities for training on contemporary oil field development technology.

Winning bidders included both state-owned national oil companies (NOCs) and publicly held IOCs. It is difficult to determine whether there were any specific Iraqi preferences for NOCs vs. IOCs in selecting auction winners, or whether the NOCs merely were able to accept in some cases a lower rate of return and higher risk than their competitors. It should be noted, however, that the Iraqis ended up with a broad based international group of countries, including operators from Russia, China, the U.S., and Europe. Such broad based representation may prove useful in not only getting a mix of approaches to field development, but also ensuring that there is wide spread international support for the projects to remain free from real and imagined threats.

Conclusions

In recent years much of the debate over peak oil has moved from a discussion of below ground concerns (geology) to above ground concerns (politics and resource nationalism). While geology is difficult to change, above ground problems can move quickly from a negative to a positive outlook (as well as the reverse). The addition of Iraq’s intended new production seems certain to delay the timing of a peak in oil production, although considerable uncertainties remain.

While the Iraqis are moving in the right direction a large portfolio of risks remain, including the absence of a comprehensive law justifying the legal framework for the auctions. Resolution of both the Kurdish-Arab struggle for Kirkuk and the oil and gas resources in Kurdistan is a political risk that hangs over the promise of the December 2009 auctions. The outstanding Iraqi debt situation with Kuwait, Saudi Arabia and the UN has yet to be resolved and could create some unique problems down the road. Several major oil companies, who chose not to bid, could not get comfortable with the lack of clarity on performance conditions of the contracts, stability of the tax regime, and the large carried interest of the Iraqi national oil company (approximately 25 percent) in the fields won by the bidders. In addition, large scale challenges remain in getting sufficient rigs into Iraq, scheduling, building, and financing an adequate and coordinated export capacity, including ports and pipelines, and even the availability of sufficient volumes of water for enhanced recovery. None of these uncertainties are insurmountable but resolving all of these issues is critical if the Iraqis are to move forward on the ambitious production program.