Diversification away from Russian gas has been a major theme, not necessarily faithfully implemented, of European energy security policy over the last 20 years. The view that “excessive” dependence on Russian gas would place Europe in a vulnerable position has been a central theme in U.S. foreign policy which has encouraged the Europeans to seek alternatives to Russian gas, through greater production from the North Sea, imports of LNG, alternative fuels, and direct pipeline links to the gas reserves in Central Asia. The Russian-Ukrainian “gas” war that took place for 20 days in January 2009 and the disruption in December 2005 have reinforced European and American concerns regarding the reliability of Gazprom as a major gas supplier. The European Union’s foreign policy chief, Javier Solana, stated that Europe had paid a heavy price from the disruption and would review its energy relations with Russia and Ukraine as a result of the interruption in gas supplies and that efforts to further diversify energy sources would move to the top of the agenda.

It is EPRINC’s assessment that the current environment of rising transit risks for European gas from Russia and lower gas prices offers an opportunity to revisit the concept of a Western European owned and operated consortium to take control of the Ukrainian and Belarusian pipelines. A more effective strategy for Europe would be not to run from Gazprom, but instead run towards Gazprom. With regard to the West’s relationship with Gazprom, this may be a propitious time to “hit the reset button.”

Gazprom, Is It Time to Hit the Reset Button?

Introduction

The Russian-Ukrainian “gas war” that took place for 20 days in January 2009 and the disruption in December 2005 are part of a long-running struggle between Ukraine and Russia over pricing and transit fees.1

The latest confrontation is the most recent in a long line of disputes, not only with Ukraine, but also Belarus, a smaller but important transit point for Russian gas moving to European markets. These pricing and delivery commitment disagreements have been an ongoing feature of Russian relations with both countries since the fall of the Soviet Union.

The most recent dispute has heightened European concerns over dependence on gas supplies from Russia. The European Union’s foreign policy chief Javier Solana said Europe has paid a heavy price because of the disruption in gas supplies and would review its energy relations with Russia and Ukraine as a result. He added that efforts to further diversify energy sources would move to the top of the EU’s agenda.

Ironically, Europe’s initial interest in gaining access to Russian gas supplies in the 1970s was the result of concerns over excessive reliance on oil imports from Organization of Petroleum Exporting Countries.2

Diversification away from Russian gas has been a major theme of European energy security policy over the last 20 years, although it has not necessarily been faithfully implemented. Europe gets about half of its gas imports from Russia, but dependence varies widely throughout the EU.

The view that “excessive” dependence on Russian gas would place Europe in a vulnerable position has also been a central theme in US foreign policy, which has encouraged Europeans to seek alternatives to Russian gas through greater production from the North Sea, imports of LNG, use of alternative fuels, and direct pipeline links to gas reserves in Central Asia.

Considering the realities of pricing and transportation costs in the European gas market, it is clear that buyers and transit partners, as well as Gazprom, bring leverage to the markets. Russia and the transit partners, for example, would suffer large and long-term losses if European customers diversified away from Russian gas. Russia’s more accessible and near-term gas production is closer to Europe than any major alternative market. Russia and Europe are bound by geography, and moving gas to Asian markets or exporting it globally as LNG, would impose higher costs on Gazprom and lower wellhead values.

At a recent presentation in London, Gazprom admitted that the Nord Stream and South Stream pipelines were meant to augment export supply flexibility rather than to increase volumes, which would put additional financial pressures on the already stretched state budget.3 From the perspective of transportation economics, Ukraine and Belarus are the low-cost routes for moving Russian gas to the European continent, a fact well understood by both transit countries.

FIGURE 1: Main Gas Pipeline Routes, Russia to Europe

Running Towards Gazprom

In light of these circumstances, and given the constrained financial environment in a low-cost oil and gas market, a more effective strategy for Europe would be to run towards Gazprom rather than away from it. European governments and natural gas companies should revisit the concept of a Western Europe-owned and operated consortium to assume oversight-control of the pipelines and in exchange offer both Ukraine and Belarus longer-term, stable revenues coupled by assistance in adjusting to a world of post-Soviet energy prices.4

Transit operations would become much more transparent, possibly requiring somewhat higher transit fees to improve the integrity of the transportation system and at the same time move the entire delivery system to a less risky profile—one that could better address both technical considerations and politics.

Although this is not the first time such a proposal has been made, recent delivery disruptions from Russia combined with deteriorating financial circumstances among all key participants in the gas market could bring the relevant parties to the table to rethink the existing delivery arrangements. With regard to the West’s relationship with Gazprom, this may be a propitious time to “hit the reset button.”

Gazprom: a price taker?

Although the European gas market historically has been dominated by state companies and a lack of transparency, the market has been open to more internal competition in recent years. Although not a hard and fast rule, gas prices are generally set by the cost of alternative fuels.

In the US where gas has virtually penetrated the entire fuel oil market, gas competes head to head with natural gas and coal. In recent years, gas prices in the US market have decoupled from oil prices, and there is growing evidence that this may be a long-term trend. In Europe, the price of gas is set by the price of oil.

As shown in Fig. 2—where the price of Brent has been pushed forward by 6 months to account for the contracting provisions in Russian gas sales contracts to Europe and multiplied by 4—the relationship between European gas prices and Brent prices has been relatively stable for over 20 years.

Figure 2: Russian Gas and European Crude Oil Prices

As a point of reference Fig. 3 shows the price of Russian gas at the German border, Henry Hub prices in the US, and delivered prices to US residential customers. Note the massive decoupling of gas prices and oil prices in the US market beginning in 2007.

Figure 3: Russian Export and US Gas Prices

While gas prices in the US have fluctuated in response to periodic supply and delivery constraints, such as cold snaps in the Northeast or hurricanes, the European market, dominated by the availability of fuel oil as a substitute to gas has maintained a stable pricing relationship between the two fuels. Although Gazprom may be able to exercise some monopoly pricing in specific markets, the price history does not support a consistent and long-term capability to do so.

Low Oil Prices, Low Gas Prices

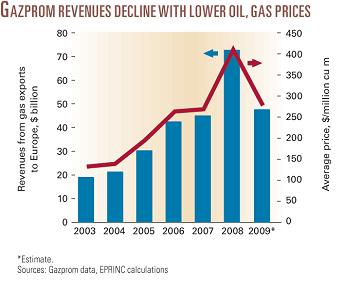

The collapse in oil prices in fall 2008 and declining economic activity throughout Europe will show up in lower gas prices and lower sales throughout 2009 along with lower revenues (Fig. 4). In 2008 Gazprom’s gas exports to Western Europe averaged a record $409/1,000 cu m (mcm), according to the company. With the collapse of oil prices beginning in July 2008, Gazprom will be charging lower prices to Europe in 2009—estimated by the company to be $280/mcm, some 32% less than the 2008 average (Fig. 5). According to a recent presentation to investors, Gazprom said its exports to Europe may decline 5% in 2009 to 170 billion cu m (bcm) from 179 bcm in 2008 and the average price will drop as stated. 5 These figures would reduce European export revenues by about $26 billion, or 35%.

Figure 4: Gazprom’s Revenue from Gas Sales, Domestic and Foreign

Figure 5: Revenues from Europe Decline with Lower Gas Prices (and Oil Prices)

Note that Gazprom’s price estimate aligns with EPRINC’s estimate in Fig. 2 based on Brent crude. Although the Russian government is raising the regulated price of domestic gas by 20%, which will increase revenues by roughly $2.5 billion, it is hardly enough to make up for the $26 billion decline in European export revenues.

Exports to the Former Soviet Union (FSU) states will also command higher prices than in 2008. Russia historically has sold gas to the FSU at discounted prices but has begun to move the FSU to European market price. However the increase is not large enough to cushion the fall in revenues from Europe and may be compounded by lower volume sales in 2009.

Across all three consumer groups, expect revenues to drop by about $22 billion compared with 2008. This number will change very little unless oil moves from $40/bbl between March and June of 2009.

Turmoil

The recent collapse in energy prices, global economic crisis, and the gas dispute with Ukraine have brought about serious financial setbacks to both Gazprom and the Russian government, which is heavily dependent on revenues from hydrocarbon exports. Each of these is partially responsible for the 76% decline in Gazprom’s stock price during 2008.

The most recent gas cutoff to Europe has imposed new financial limitations on Gazprom with a loss of well over $1.1 billion in direct revenues for the 20 days in January 2009 in which gas flows to Europe were halted.

Financial constraints resulting from the global economic downturn, combined with the collapse in gas prices, are likely to hinder Gazprom’s ability to maintain and grow production in existing fields and fund many of its planned investment projects.

An analysis of Gazprom’s current financial standing presents genuine constraints to future growth. As shown in Fig. 5, projected lower gas prices in the European market in 2009 will further diminish its revenue, which will adversely affect state revenue. The Kremlin owns 50.002% of Gazprom through various companies and relies on Gazprom for both its tax base — the company pays taxes equivalent to about 20% of the Russian Federation’s annual budget—and subsidized gas. The state’s dependence on the gas company implies that it will continue to provide financial assistance to Gazprom but may find it more difficult to do so than it had expected.

The government has been spending billions of dollars from its reserves to bail out industrial companies and banks and to prop up the ruble since the economic crisis hit. Meanwhile, revenues from mineral and hydrocarbon exports have dried up. Covering the monopoly’s current projects and expansion plans, which require massive financial commitments, will not be an easy task.

Torn: Projects vs. Debt

Gazprom is a giant torn between expensive projects and debt. Its revenue woes are compounded by billions of dollars of debt—much of it due in 2009—and expensive projects necessary to maintain and grow production. The company has stated that it will maintain 2009 spending as planned but that long-term projects will have to be prioritized.6 Gazprom approved its 2009 investment program amounting to 920.4 billion rubles ($26.3 billion), significantly higher than the 2008 budget of 821.7 billion rubles ($23.4 billion). Of that amount, 699.9 billion rubles is budgeted for capital expenditures and 220.6 billion rubles for long-term financial investments. 7

Recent developments suggest that Gazprom may be reevaluating its investment plans after first-quarter 2009 as oil prices remain lower than expected.8

Gazprom is at a point where it must select projects carefully. Many of its fields in western Siberia, mostly commissioned during the Soviet era, are in decline, putting promises of future production at risk. These concerns are forcing Gazprom to develop riskier plays such as Shtokman in the Barents Sea.

Gazprom also has plans for further development of Yamal in Northern Siberia and two elaborate pipeline projects, Nord Stream and South Stream, both of which circumvent Ukraine. Officials have remained confident that the company’s main projects, namely Shtokman, Yamal, and Nord Stream will continue as planned. There is concern, however, as to whether Gazprom can simultaneously carry out these ambitious projects as revenues and demand decline and large amounts of debt come due this year.

Shtokman is a gas field in the Barents Sea containing an estimated 3.8 trillion cu m (tcm) of gas. It is expected to begin producing gas in 2013 at the earliest, though development has yet to begin and Gazprom’s minority partners in the project, Total and StatoilHydro, have yet to finalize investment plans. Initial development is expected to cost $12-20 billion and could grow more expensive over time. It is planned as a feeder field for Nord Stream, which if completed in 2011 will take gas from Russia directly to Germany under the Baltic Sea.

The Shtokman Development company said in December 2008 that nearly 70% of Shtokman will have to be financed and that a minimum price of $50-60/bbl for oil is required to make the project feasible.9 This implies a minimum required price of $225-$300 per thousand cu m for gas from Stokman, whereas current production from Soviet era fields has an average cost of under $10/mcm.

The Yamal peninsula, crucial to Gazprom’s future, is scheduled to begin producing gas in 2011. Its largest field, Bovanenkovo is estimated to contain 4.7 tcm of gas, and the company says production will eventually reach 140 bcm/year. A 1,100 km west-bound pipeline begun in 2008 will connect Bovanenkovo to Gazprom’s Ukhta hub, which will allow for exports to Europe via the existing Yamal-Europe pipeline through Belarus. In all the peninsula contains at least 16 trillion cubic meters of gas according to Gazprom’s estimates.

The development of the fields in the Yamal peninsula may cost upwards of $100 billion with Bovanenkovo alone costing $60 billion. Between Yamal, Stokhman, Nord Stream, and South Stream, Gazprom is planning projects with a combined cost of around $120 billion, most of which it is likely responsible for, with planned completion dates of either 2011 or 2013, depending on the project. Ground has not been broken on Shtokman and South Stream, and the projects have a level of technical difficulty Gazprom has not had to tackle in its Soviet era fields.

Gazprom has set laid out extremely ambitious development plans. It appears as if the company has erred on the side of optimism, as timely completion of any one project will be very difficult to achieve given current economic factors and the lack of progress made on projects thus far.

Heavy debt burden

If massive revenue declines and exorbitant project costs are not enough to make the Kremlin anxious about Gazprom’s well-being, there is the issue of its debt. The company currently carries about $42 billion in debt and is obligated to make payments of about $10 billion in 2009.13 14 The company borrowed heavily to acquire energy companies and make acquisitions often regarded as politically motivated, such as Sakhalin II and Beltransgaz, among others.

Many saw the acquisitions as part of a renationalization effort led by the Kremlin. Those acquisitions and others like it, such as Sibneft, along with the need to finance parts of projects, caused Gazprom to triple the value of liabilities on its balance sheet during 2002-07.15

Gazprom’s debt will certainly impede its ability to pay for projects in the future, particularly when payments of $10 billion are due the same year that revenues drop by $20 billion, and credit is needed to push grand expansion plans forward. The company has announced intentions to refinance portions of its debt. However, tight credit markets will make refinancing difficult, as the company has acknowledged.

The cost of Gaz Capital (Gazprom’s financing vehicle) credit default swaps has risen to 981.1 basis points from 236 basis points over the past 6 months, meaning it now costs $981,100 to insure $10 million of Gazprom’s debt for 5 years.16 However, there are signs that the company can manage its debt. Uralsib said it believes Gazprom will be able to make its 2009 payments, but noted that because of the ruble’s recent depreciation the company may take currency losses as it converts rubles to pay debts denominated in foreign currencies such as the dollar and euro. And of course, the Kremlin cannot allow this apple to fall from the tree.

Gazprom has said that only 3% of its export revenue is being used as collateral for outstanding debt and that it will use additional export revenues as collateral in its effort to issue bonds worth 90 billion rubles ($2.6 billion) planned for later this year. The bond sale is to be used to refinance debt but will not occur until credit markets loosen.

Access to additional credit lines may be limited given legal constraints on Gazprom that prohibit

the company from settling its debt through the sale of its strategic oil and gas assets. An alternative is to borrow directly from the Russian government.

Bailout program

Russia has rolled out a $50 billion bailout program for the Russian economy, with $9 billion allocated for oil and gas corporations. Gazprom is hoping to receive $5.5 billion.17 The company’s well-being is critical to the health of Russia and its economy: Gas exports are responsible for about 10% of the country’s gross domestic product, and its exports to Europe constituted about 15% of Russia’s total export revenues in the first half of 2008.18

The Kremlin’s ability to deliver gas to its citizens at a fraction of the cost gas is sold to Europe is a luxury afforded to it by Gazprom. The Kremlin can ill afford to lose that luxury and subject Russians to gas at European prices. And with tax payments equivalent to 20% of the federal budget, the company is a much needed revenue source.

The government cannot let Gazprom fail—not that failure is on the horizon—but its willingness and ability to finance Gazprom’s planned capex is questionable as it bails out industries, banks, and the ruble, and announces a large budget deficit for 2009 after years of budget surpluses.

Challenged with financial constraints, both Gazprom and the Russian government are expected to show more flexibility to attract foreign investors and look for strategies to secure access to markets. Cooperative ventures and even government-to-government initiatives that would lower operation costs, facilitate production growth, restore its relations with investors, and reduce investment risk are all likely to get a much harder look.

Gazprom’s sizable 2009 investment program needs continuous cash flow, which will be a challenge to sustain in the face of low liquidity and sparse credit availability. Seeking financial contributions from various project partners would be appealing, as demonstrated by Gazprom’s willingness (or perhaps need) to take on partners in Nord Stream and Shtokman.

European Market Critical

While oil consumption is still a major source of commercial-industrial use in Europe, the demand for gas is steadily growing to complement nuclear power and coal (Fig. 6). Although not everyone agrees, conventional wisdom is that by 2020 Europe is likely to see its gas consumption rise by 25%, with increasing supplies coming from imports, as domestic production likely will fall by more than 40%.20 Fig. 7 shows Russia’s primary nondomestic gas customers.

Western Europe has limited gas reserves, mainly in the North Sea, and some argue that production is reaching or has reached its peak.21 According to the European Committee on Economic Affairs and Development, “Germany, France, the Netherlands, Spain, and Italy are among the world’s 10 largest importers of crude oil, while the same countries and Turkey are also among the 10 largest gas importers.”22

Figure 6. Europe’s Energy Composition (EIA 2005 Data)

Figure 7: European Consumers of Russian Gas

Despite Gazprom’s worsening financial situation and complex relations with downstream partners such as Ukraine, Russia has a commitment to meet 25% of Europe’s gas needs. Russia exports roughly 465 million cu m/day to Europe, and 80% of that flows through Ukraine. Wealthy Western European nations generally exhibit less dependency on Russian gas than poorer, Eastern European nations (Fig. 8). That trend is vaguely reflected in Fig. 6, which shows that non-Organization for Economic Cooperation and Development (OECD) countries in Europe and Eurasia use more gas than OECD Europe, but get less energy from all other types of fuel.

Much of the FSU still receives Russian gas at a subsidized rate, although Gazprom is moving prices to market rates, partly because it purchases 60 bcm/year of gas from Central Asia. That gas, which is then exported to Europe, is no longer accessible at prices well below market values. Central Asian producers have moved, or can threaten to move, their production to more lucrative markets (China, Nabucco).

Figure 8: European Dependence on Russian Gas

In 2008 exports to Europe generated $73 billion in revenue for Gazprom, compared with domestic sales revenue of $37 billion and exports to the FSU of $14 billion. Even though Europe represents only about 30% of Gazprom’s sales volume, it accounts for 60% of its revenues. In 2008 Russian customers paid about 1/8th

the rate per mcm as European importers paid.

As the European market is Gazprom’s largest revenue source, it is perhaps as dependent on Europe in terms of market access and revenue as Europe is dependent on Gazprom. As EU Energy Commissioner Andris Piebalgs said: Gazprom’s decision to export most of its energy exports to Europe is because Europe is a familiar market and the market economy where Russians know they “will get very good profits for their gas.”24 Gazprom saw record export revenues in 2008 for its gas as European gas prices topped $500/mcm towards the end of 2008. However, with the rapid collapse of oil prices in the fall of 2008, the prices declined as well.

Recently, Alexander Medvedev,

deputy chairman of Gazprom‘s management committee, announced that gas exports to Europe would be reduced if the economic decline persists and energy demand falls further.25 Gazprom said it would wait until the end of the first quarter of 2009 before deciding on a cutback in exports if demand falls sufficiently in Europe.26 The effects of the fall in production could be felt more sharply in the longer run, potentially leading the company to seek financial assistance from its foreign partners to develop new fields.

Figure 9: Revenues by Market

The Pipeline Dilemma

Gazprom’s potential obstacles in financing major projects do not end with development of upstream resources. The 55 bcm capacity Nord Stream pipeline, intended to connect Russia directly to Western Europe without transiting any Eastern European countries, would serve dual purposes. It would avoid Ukraine and would add capacity to the existing system if European demand increases and new supplies come online. It is already facing rising costs and delays, however. The Nord Stream consortium has elevated the cost of the originally 4-5 billion-euro pipeline to 8 billion euros ($11.64 billion).

Figure 10: Nordstream Pipeline Route

Complex negotiations with Baltic littoral states to get permits to build the undersea pipeline have further stalled the project. Similarly, the fate of the South Stream gas pipeline, which is planned to link Russia with Austria and Italy via a pipeline through the Black Sea, is beset with more delays and cost overruns. The project may cost over $31 billion, as opposed to the $20 billion announced in July 2008 by Russia’s Energy Minister Sergei Shmatko. It also would carry a maximum of 47 bcm/year—8 bcm/year less than the planned Nord Stream. See Tables 1 and 2 for a breakdown of costs, capacities, and completion dates.

Construction of the onshore portion of Nord Stream has begun, though not the tricky undersea portion, meaning Nord Stream has some momentum behind it, although perhaps not enough to see it through to completion. South Stream has not left the planning phase, leading many to believe it is little more than a fantasy.

Table 1: Proposed Pipeline Projects

| Estimated Cost ($) | Capacity (*planned) | Planned Completion | |

| Nord Stream | 11.64 billion | 55 bcm* | 2011 |

| South Stream | 27.6-35 billion | 31-47 bcm* | 2013 |

| Nabucco | 11.5 billion | 31 bcm* | 2013-2014 |

Table 2: Unit Cost of Russian Exports Through Ukraine and Proposed Pipelines

| Costs per thousand cubic meters (mcm) | |

| Ukraine | $22/mcm transit fee* |

| Nord Stream | $10.58/mcm** |

| South Stream | $29.36-$37.23/mcm** |

| *At current rate of $1.7/mcm per 100km, does not include subsidized gas. | |

| **Assumes full capacity over 20 years with no interest. | |

The latest Russia-Ukraine gas crisis has clearly encouraged Gazprom to move forward quickly with Nord Stream construction. While Nord Stream solves some problems by bypassing all existing transit states with the contentious pipeline disputes common in central and Eastern Europe, it also opens concerns that the project will bolster Russia’s leverage in the region.

Once Nord Stream is up and running, least cost strategies for dispatching gas to the European continent may lead to the abandonment of transport volumes along established transit routes in favor of shipping gas through Nord Stream.27

Reliance on Nord Stream may create so-called network risks, i.e., it offers Gazprom the opportunity to deliver supplies to its western European customers while remaining in a position to curtail supplies to some of the gas-dependent Eastern European countries, particularly Poland. While this is a genuine concern, Russia has so far been reluctant to cut off customers paying market prices.

Risks

Although Nord Stream appears to be moving forward, it does face some completion risks, both from cost overruns and from opposition from littoral states. Vladimir Milov from the Russian Institute of Energy Policy argues that the pipeline will cost at least $13 billion and is an ecologically dangerous construction that may not be financially justified.28

Russians have taken a large part of the financial risk and have already begun construction on their end and are putting various supply and service contracts in place. Even based on the higher construction cost estimates, Nord Stream should be able to operate within a cost structure competitive with existing transit costs for moving supplies through Belarus and Poland. Additionally, Europe is expected to see substantial growth in longer-term gas demand, and Nord Stream should handle the new volumes.

One big “if” with regards to Nord Stream is Shtokman field. Gazprom apparently is building Nord Stream with the intention of feeding it with Shtokman gas. As discussed earlier, ground has not yet been broken on Shtokman, and it is set to begin production 2 years after Nord Stream is scheduled to be completed in 2011, creating doubt about the viability of a 2013 start.

Gazprom’s success in developing Shtokman, or lack thereof, will further impact the viability of Nord Stream. If Gazprom can bring the two projects together in a relatively timely and economic manner, it could become a powerful asset for Gazprom.

Even before gas prices collapsed and the financial crises hit, Nord Stream was far from being a certainty; now it is even less so. Whether or not Nord Stream fulfills its objectives and becomes a cost-effective project, resolving the transit risks in Ukraine and Belarus will still generate substantial benefits to the producer, shippers, and consumers.

European solution

As Gazprom faces rising costs of current production and expansion plans while its revenue are in sharp decline, Ukraine is in a position to extract “economic rent” in terms of higher transit fees, discounted gas, and stolen gas. The situation is inherently unstable because the alternative for Russia is to pay a very high price to go around Ukraine in the form of Nord Stream or South Stream.29

But Ukraine could potentially jeopardize its position and lose both its economic rent and political leverage if the Russians in fact go ahead with either pipeline. In this environment, the Europeans have the opportunity to unite and step in to provide stability to the Russians and a reliable long-term commitment to the Ukrainians, who arguably have the most at risk.

References

Many analysts view Gazprom’s disputes with Ukraine, and even Belarus, as less a struggle over how much economic value the transit country should be permitted to extract than part of a longstanding geopolitical struggle over the future of Ukraine—and to lesser extent Belarus—and also a signal to Europe that access to Russian gas supplies requires not just payment for supplies delivered, but political support as well for Russian foreign policy initiatives. The arguments against reliance upon Russian gas seem to fall into the following three categories: Dependence equals leverage; Gazprom is engaged in monopoly pricing; Unfettered access to the lucrative markets of the European continent provides direct financial assistance to an autocratic regime.

2 Yergin, Daniel, The Prize: The Epic Quest for Oil, Money, & Power, (Free Press: January 1993), p. 742.

3 “???????, ?? ?? ??????,” (Knockdown, But Not a Knockout) Ekspert, Feb. 23, 2009.

4 Proposals to develop a consortium to manage the Ukrainian pipeline system have been proposed in various forms since the 1990s. As recently as June 2008, Alexander Medvedev, deputy chairman of the board of executive directors and the director-general of Gazprom’s export arm, proposed such a consortium. For a full discussion of a well-thought-out consortium plan, see “The Case for a Gas Transit Consortium in Ukraine: A Cost-Benefit Analysis,” Elena Gnedina & Michael Emerson, Centre for European Policy Studies, Jan 19, 2009. Retrieved at (http://www.ceps.eu/index3.php).

5 “Gazprom May Delay South Stream,” Oil & Gas Eurasia, Feb. 9, 2009, (http://www.oilandgaseurasia.com/news/p/0/news/3942/).

6(http://business.timesonline.co.uk/tol/business/industry_sectors/natural_resources/article5704796.ece).

7 “Gazprom approves $33 billion investment program for 2009,” RIA Novosti, Dec. 23, 2008, (http://en.rian.ru/business/20081223/119136252.html).

8 Kommersant reported on Feb. 25, 2009, that Gazprom is reevaluating its 2009 investment program, which assumed $50/bbl oil, and is using an oil price of $41/bbl to evaluate the feasibility of its projects. The article notes that the company may eventually use $25/bbl oil as a metric. Investments for 2009 are to be cut by 200 billion rubles ($5.7 billion), but major projects will not face cuts.

9 “Shtockman, Yamal, or both?” Barents Observer, Dec. 12, 2008, (http://www.barentsobserver.com/shtokman-yamal-or-both.4536847-116319.html)

10 (http://en.rian.ru/analysis/20090210/120076254.html).

11 “Gazprom Launches Construction of Bovanenkovo-Ukhta Submerged Crossing,” Oil and Gas Eurasia, Aug. 15, 2008, (http://www.gasandoil.com/goc/news/ntr83986.htm).

12 “Russia”s Gazprom, Rosneft Debts Seen Entailing Huge State Bailout,” Gazeta.ru, Mar. 11, 2008.

13 (http://www.themoscowtimes.com/article/1016/42/374642.htm).

14 Mortished, Carl, “Gazprom to Curb Spending and Delay Development,” Times Online, Feb. 11, 2009.

15 According to Gazprom’s 2007 annual report, available at (www.gazprom.com)

16 (http://www.themoscowtimes.com/article/1009/42/374543.htm).

17Kramer, Andrew, “Gazprom, Once Mighty, Is Reeling,”

International Herald Tribune, Dec. 30, 2008.

18 Zhdannikov, Dmitry, “Gazprom Debt Burden to Speed Up Gas Crisis End,” Reuters, Jan. 14, 2009.

19 “Shtockman, Yamal, or Both?” Barents Observer, Dec. 12, 2008, (http://www.barentsobserver.com/shtokman-yamal-or-both.4536847-116319.html).

20 “The Future of the Natural Gas Supply in Europe,” A.T. Kearney Gas Study, Jan. 30, 2008, (http://www.atkearney.be/index.php/Our-impact/at-kearney-gas-study.html).

21 Bahgat, Gawdat G., “EU seeks energy security in stronger supplier ties,” (OGJ, Oct. 10, 2005).

22“Europe’s growing energy vulnerability,” Report of the Committee on Economic Affairs and Development, Parliamentary Assembly, Feb. 22, 2005.

23 “European Dependence on Russian Gas,”

Russia Today, Jan. 13, 2009, (http://www.russiatoday.com/news/news/35846).

24 “EU: Energy Official Downplays Gazprom Expansion Threat,” RFERL, Jan. 25, 2008.

25Webb, Tim, “Gazprom plans cuts to European exports if gas demand slumps,” The Guardian, Feb. 10, 2009.

26 Ibid.

27 Lochner, Stefan, and Bothe, David, “From Russia with gas: An analysis of the Nord Stream Pipeline’s impact on the European Gas Transmission System with the Tiger-Model,” EWI Working Paper, No 07.02, Institute of Energy Economics at the University of Cologne, Germany, Sept. 2007, p. 15.

28 “??? ??????? ? “???????? ???????,” ?????? ????? ?????????? ??????? ?????????? ? ????????: ?????????? ??????,” (Why toil with “Nord Stream,” Russia is better off to form a gas consortium with Ukraine: Expert Assessment), Regnum, Oct. 17, 2007, (http://www.regnum.ru/news/901063.html).

29 Nord Stream does have lower per unit transit costs than current costs for Ukrainian transit, but these costs are “on paper,” and the project has yet to be completed. It faces considerable completion risk and a high likelihood of further cost overruns. In addition, eventually European gas demand will grow to the point where Ukrainian, Belarusian, and Nord Stream lines will reach capacity. Hence, the imperative to sort out the instability in the Ukrainian and Belarussian routes remains.