December 21, 2011

(Download PDF version for citations)

Over the past 18 months EPRINC has published several assessments on the economic benefits of the proposed Keystone XL pipeline. The project has been subject to an environmental review for the last three years with expectations a decision would be made by early 2012. However, the Obama Administration recently decided to delay a decision on whether to issue a permit for the pipeline until 2013 in order to evaluate an alternative route in Nebraska. Congressional concerns over further delays on the project are now generating legislative initiatives to accelerate a presidential decision on the project.

The pipeline is opposed by many environmental groups who seek to constrain further development of Canadian oil sands and view halting the pipeline as an effective strategy to do so. Opponents of the project also have raised concerns that the benefits of the project are over stated since rising shipments of Canadian oil sands to the U.S. Gulf Coast may also yield higher export volumes of refined petroleum products.

As shown in Figures I and II below, the U.S. imports approximately 11 million barrels a day (mbd) of crude oil and petroleum products. But the U.S. also exports over 3 mbd of petroleum products. Over the last five years, rising exports of refined petroleum products have contributed to the decline in net imports, which have fallen by 3 mbd to 8 mbd. Of the 8 mbd of net crude and petroleum product imports, 2.5 mbd are sourced from Canada.

Figure I. U.S. Imports of Crude Oil and Petroleum Products and Net Imports

Source: EIA

Figure II. U.S. Imports, Exports, and Net Imports of Petroleum Products

Source: EIA

Transporting Petroleum Products and Refining Efficiencies

One way to address the concern over rising volumes of exports of petroleum products is to require their use only in the U.S. In this scenario, petroleum products from Gulf Coast refining centers would be shipped to consuming centers in the U.S. which are now importing petroleum products. A ban on exports would impose higher transportation costs for much of the domestic refining industry. However, given the large land mass of the national economy it is more cost efficient to sell some volumes of petroleum products to near markets in Latin America from the Gulf Coast and import petroleum products into the East and West coast consuming centers. Because of Mexico’s close proximity to the Gulf Coast, it remains the largest petroleum product export market, but other significant volumes end up in Brazil, other Latin American countries, and Canada.

The net effect of a ban on petroleum product exports would be to raise the cost of petroleum use in the national economy since gains in transportation efficiencies would be unavailable and refinery utilization rates would fall as refiners faced rising costs from higher transportation fees. Such a policy would be counter-productive and increase the volume of net imports and forego the value-added benefits from higher utilization rates at U.S. refineries.

Refiners produce a joint product, i.e., it is not possible to produce gasoline without also producing other products, such as distillate or diesel, kerosene (jet fuel), heavy fuel oil, petroleum coke, etc. World petroleum product markets are highly cost competitive and restrictions on either access to feedstock and/or limitations on sales into world markets will harm refinery profitability and reduce the economic benefits of value added processing within the national economy.

Canadian Oil Sands and U.S. Energy Security

Energy security is not directly tied to the level of U.S. import dependence. The energy security threat the U.S. faces is instead the direct result of a concentration of low cost reserves in an unstable part of the world. This poses two costs or risks to the U.S. economy, (1) the price of oil is higher than would prevail in more competitive environments resulting in wealth transfers from U.S. consumers to foreign oil producers, and (2) the potential of a “price shock” to the U.S. economy is high should supplies be disrupted from any of the major producing regions. The U.S. is well integrated into the world market and reducing imports provides some “energy security” benefits, but these are limited. The large payoff in terms of energy security is bringing on new and diversified supplies into the world petroleum market free from the instability of war and domestic turmoil. Surging production from Canada is particularly beneficial because rising oil sands production comes from one of the most stable regions of the world and the integrated investment patterns between the U.S. and Canada provides a high level of economic benefit to the U.S.

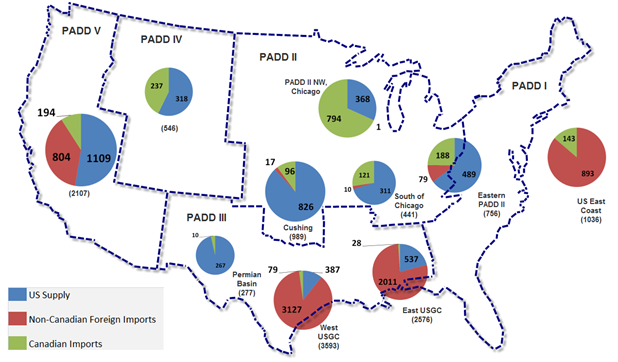

And although Keystone XL would provide direct employment in the U.S. from its construction, it would also provide essential transportation infrastructure for shifting patterns of upstream production in the continental U.S. by adding 100,000 barrels a day of capacity for moving North Dakota production to coastal refining centers. As shown in Figure III below, U.S. and Canadian oil production dominate all the processing centers in the mid-continent. Rising liquid production from Canada, North Dakota, and (soon) from Ohio will require new transportation commitments (both rail and pipelines) to move the supplies to coastal refining centers.

Figure III. U.S., Canadian, and Foreign Crude Disposition by Region, 2010, Thousand Barrels per Day

Source: EPRINC rendition from Enbridge. Enbridge: Enbridge used EIA and NEB Data and Enbridge Estimates (with some averages)

Oil markets are highly sensitive to expectations among buyers and sellers with regard to investment commitments and the volume of future production. The construction of the Keystone XL pipeline would send a clear signal to Canadian and U.S. producers that a critical piece of the North American petroleum transportation infrastructure is underway. It would inform investors in Canada, the US, and abroad (including OPEC) that North America is putting into place an essential building block for the emerging North American petroleum renaissance.