In an interview with Kevin Killough for JusttheNews, Energy Policy Research’s Director of Energy Transition Research Batt Odgerel discussed California’s Advanced Clean Cars II regulation and its potential impact on US carmakers and consumers. The article, “California likely to fight for EV mandate, but data shows that EV sales way below mandate targets,” was published May 22, 2025.

From JusttheNews.com:

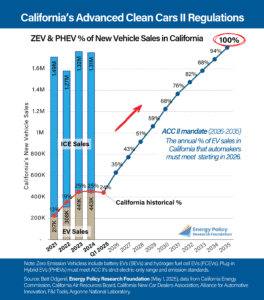

“Batt Odgerel, director of energy transition research at the Energy Policy Research Foundation, compared the rate of EV adoption in California over the last few years with the future targets that California’s ACCII aims to achieve.”

“From 2021 to 2023, the percentage of new car sales that were electric vehicles rose from 13% to 25%. In 2024, there was no increase, and in the first quarter of 2025, it fell to 24%. The ACCII demands that the percentage of new car sales that are electric hit 35% by 2026.”

“Odgerel told Just the News that when the ACCII was being drafted – the rules were finalized in 2022 – it’s likely California officials thought the increases in electric vehicle sales would continue.”

“’It was still very high, and I think in that environment, California officials were probably blinded and assumed non-stop linear growth until 2035,’ he said.”

“The increases were also partly due to the state’s Clean Vehicle Rebate Project, which provided state-funded incentives for the purchase of new electric vehicles, in addition to federal tax credits. The project ceased taking new applications in November 2023.”

“’When the subsidies get exhausted, reality hits,’ Odgerel said.”

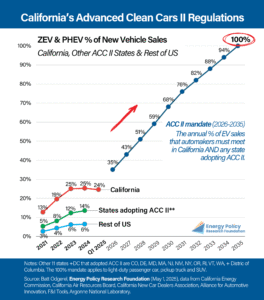

“He said that in the 11 other states and the District of Columbia that have adopted California’s ACCII, EVs are only 14% of new vehicle sales. The ACCII requires that 43% of all new car sales be electric by 2027. To reach that, the share of sales that are EVs in these other states and D.C. will have to triple in just two years. Adoption of the ACCII, Odgerel said, will not guarantee a successful transition to EVs.”

“’As such, the ACC II poses a major risk of resource mis-allocation across the country,’ he said.”

“’Ultimately, reaching the targets will require massive increases in state and federal subsidies,’ Odgerel said.”

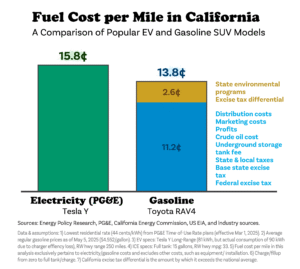

“Odgerel also compared the California fuel costs per mile of a Tesla Model Y, the company’s newest model, to that of a gas-powered Toyota RAV4. California’s Model Y drivers will pay $0.158 per mile, and the RAV4 drivers will pay $0.138. In addition to these costs, charging infrastructure is still underdeveloped, he said, and the purchase price of EVs is higher than that of gas-powered vehicles.

“This entails increased burdens for consumers and higher energy prices across the board,” Odgerel said.

“He notes that the comparison is based on various assumptions, and actual numbers will vary in different cases. Likewise, without California’s gasoline policies, which drive up the cost per gallon, the savings for gas-powered cars would be even higher.

“The ACCII applies to car manufacturers and not to the buyers. So, if EV purchase and operation costs are not competitive with gas-powered vehicles, consumers will have the option of buying gas-powered vehicles in states that allow them or hanging onto their current gas-powered car.

“Therefore, a heavy-handed government approach could result in not-so-desirable second order effects like increasing ICE [internal combustion engine] car prices,” Odgerel said.

“Low consumer demand for EVs will also increase inventories on sales lots, something that has already become a problem in California and elsewhere. The situation could exacerbate the losses automakers have experienced with their EV lines.”

Also on this topic, see the Chart of the Week on Fuel Cost per Mile in California:

© Energy Policy Research Foundation | 25 Massachusetts Ave NW, Suite 500P (Mailbox 14), Washington, DC 20001 | (202) 944-3339 (Phone) | (202) 364-5316 (fax) | info@eprinc.org

Design & Development by Red Clay Creative