Download PDF version of report for citations

The Bakken Boom – JAPANESE VERSION

North Dakota has been an oil producing state for 60 years, but only during the past three years has the Bakken oil boom made it the fourth largest oil producing state in the country and one of the largest onshore plays in the United States. The Bakken extends beyond North Dakota into Eastern Montana and neighboring territories of Saskatchewan and Manitoba in Canada. While its success has been largely attributed to advances in oil field technology, primarily horizontal drilling and hydraulic fracturing, a number of circumstances have come together to make the Bakken a successful oil play, including high oil prices, widespread and ready access to privately held prospects, and low natural gas prices.

The USGS (U.S. Geological Survey) estimates the technically recoverable reserves in the Bakken at 4.3 billion barrels. Reserve estimates by states and companies are often significantly larger and in the past these estimates have been considered optimistic. However, many wells have had initial production (IP) rates of 2,000 barrels of oil per day (b/d). These IP rates suggest that estimates of the resource base will continue to rise. Higher estimates for the basin of 10 billion barrels or more can no longer be ruled out.

Similar to the early days of the shale gas revolution, major oil companies have been largely absent in the Bakken. Small and independent oil companies that made their start developing natural gas resources moved into the Bakken and accumulated acreage before the oil play became fully established. Today, the most sought after acreage in the Bakken is already leased. New entrants into the Bakken must participate in joint ventures or buy out another company. This has not discouraged investment. Several billion dollars were exchanged in mergers and acquisitions (M&A) in the Bakken in the fourth quarter of 2010 alone.

With 2010 production at 350,000 b/d and WTI (West Texas Intermediate) oil prices around $100/barrel in past months, North Dakota’s Bakken is drawing a lot of attention. However, because of limited access to traditional transportation infrastructure such as pipelines, Bakken production is expensive to deliver to major refining centers and hence is discounted heavily at the wellhead.

This is the first of several EPRINC reports which will address the potential of shale oil plays to substantially expand domestic oil production and the subsequent implications for the distribution of crude oil to the mid-continent and ultimately throughout the United States. EPRINC is also evaluating the central features that have made the Bakken play a success to date, and how both existing constraints and emerging infrastructure developments will affect development in the coming years. Whether production from the larger Williston Basin can transform the prospects for U.S. field production in the coming years will largely be determined by geology and technology, but government policy affecting the pace of infrastructure development and access to new plays will also play a central role.

The Williston Basin Formation and the Role of Technology

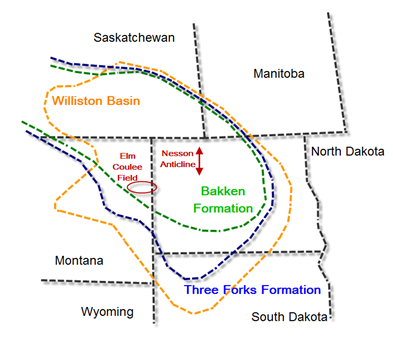

The Bakken and underlying Three Forks formation are part of the larger Williston Basin which encompasses Saskatchewan, Manitoba, North Dakota, Montana, and South Dakota (see figure 1). Bakken producing zones are mainly present in Western North Dakota, Southern Saskatchewan, and Eastern Montana. The Bakken is one of the largest (possibly the largest) continuous oil accumulations in the world. It is an over pressured system which is in part responsible for high IP rates. The high pressure in the formation suggests that the oil is contained within the petroleum system. This means that the oil remains in place and is tightly contained throughout the geologic structure. Ten years ago both reserves and productive capability were highly uncertain. But today Bakken shale oil is not only accessible but also profitable given advances in technological know-how and sustained high oil prices.

Figure 1. Map of Williston Basin with Bakken and Three Forks Formations

Source: EPRINC

Shale oil has historically been difficult and costly to produce because it is found in formations characterized by both low porosity and low permeability. Large and sustained investment in oil production has not taken place in North Dakota until recently because traditional vertical well technology and production methods touched only a portion of the producible rock. This left the wellbore (the drilled hole exposed to the producing rock) exposed to only a small portion of the tight oil formation, preventing it from being produced to its full potential. Attempts to access the resource using horizontal drilling technology had been tried in the past, but had not advanced to longer laterals and multiple hydraulic fracturing stages in the right layer or rock. Studies and papers dating back to the 1970s suggested there are billions of barrels of oil in the Williston Basin; it was recognized that producers simply could not reach the pay zones with available technology. Additionally, the lower price environment discouraged such investment.

The first oil producing well, Clarence Iverson No. 1, was drilled by Amerada Petroleum Corporation and began producing on April 4th 1951. This marked the beginning of North Dakota oil production. This well was on the Nesson Anticline, now known as a “sweet spot” of the Bakken, home to natural fractures in the rock. The Bakken Formation first produced in 1953 from the #1 H.O. Bakken well named after Henry Bakken, the landowner, and was also drilled by Amerada.

The Bakken is a shale oil play. It is conventional, light-sweet crude oil, trapped 10,000 feet below the surface within shale rock. The Bakken shale play consists of three layers, an upper layer of shale rock, a middle layer of sandstone/dolomite, and a lower layer of shale rock. The middle sandstone layer is what is commonly drilled and fracked with the horizontal lateral today (see figure 2). The precise location of the oil the companies are producing from (from which layer or rock) is still under evaluation, but as technology and understanding of the geology improve, companies will be able to see how far their hydraulic fractures penetrate and into which rocks they are accessing the resource. This knowledge will allow companies to better understand acre spacing requirements and in turn maximize their acreage positions and drilling capability. The Three-Forks formation, which is being drilled just below the Bakken, is thought to be contributing oil volumes separate from the Bakken, potentially adding to total recoverable reserves. While the most heavily produced zones in the Williston Basin have been the Bakken and underlying Three Forks, there are other promising zones in the basin that offer potential as drillers learn more about the geology and oil field technology advances.

Figure 2. Example of Horizontal Drilling in the Bakken

Source: EPRINC. Not drawn to scale. * Although still under evaluation, it is likely that fractures extend into the surrounding shales, pulling oil from the shales.

Companies in the Bakken have improved their techniques, combining horizontal drilling with multistage fracking and longer laterals. Horizontal drilling began in the 1980s, but has not been widely used until this past decade. In the early 2000s Bakken players began drilling horizontal laterals into the Middle Bakken, the sandstone layer between the two shale layers. This proved to be conducive for drilling and production. Over the past few years the number of frac stages has dramatically increased. This increases the cost of drilling, but also increases initial production rates and the ultimate recovery of oil from the well. Only a few years ago the number of frac stages were much lower (single digits), but now they are commonly above thirty and many are above forty. Forty fracture stages are allowing for ultimate recovery figures between 600,000 and 700,000 barrels of oil per well. Horizontal laterals, now common in the Bakken and other shale play across the country, were once around 4,000 feet and are now as long as 10-15,000 feet.

Fracking a well involves making small initial cracks in the rock by perforating the wellbore and then pumping water, proppant (sand, ceramic, or resin coated sand), and a small amount of chemicals down the wellbore at high pressure to open up the fractures and allow oil to flow from the rock formation into the wellbore. Fresh water is needed to frac a well in order to create clean fractures which allow oil to best flow from the rock to the wellbore. Three million gallons of water and two to three million pounds of sand or proppant are needed per well. The proppant is what helps hold open the cracks in the shale so they do not close up. The choice of which type of proppant often depends on the geology of the well. Resin coated sand and ceramics are more expensive than sand, but can withstand higher closure pressures within the fracture. Ceramics are manmade so they are more perfectly spherical and this can help increase permeability in the fracture and allow oil to better flow around the proppant in the fracture and up into the wellbore.

Reserves

The extent of recoverable reserves from the Bakken is subject to debate and ongoing surveys are underway. When the USGS revised their 1995 estimate of 151 million barrels to 4.3 billion barrels in 2008, it reflected rising confidence in the early results of the drilling program that was beginning in the Bakken, investment by independents, successful application of new technology, and high IP rates. In January of 2008 North Dakota produced 138,000 b/d; in November of 2010 North Dakota production was over 356,000 b/d. Any revised estimate is likely to be much higher than 4.3 billion barrels. In January 2011 North Dakota state officials began saying there were 11 billion barrels in North Dakota alone. This is up from their previous message of five billion barrels.

Figure 3. Reserve Estimates

Rising Production and Potential Constraints

Williston Basin production, which includes North Dakota, Eastern Montana and South Dakota is currently around 415,000 b/d.

Figure 4. Williston Basin Production

Source: NDPA (North Dakota Pipeline Authority)

Oil production in North Dakota has more than doubled since 2008 and currently stands at around 350,000 b/d, making it the fourth largest oil producing state in the United States. Production hit a high in April 2011, over 360,000 b/d, and has since declined slightly due to severe spring flooding which caused well shut-ins and production delays. North Dakota currently represents approximately 6% of U.S. oil production and many analysts estimate this to breach 10% in the next several years with production reaching 700,000 b/d. The Bakken formation’s share of North Dakota production is around 300,000 b/d or 75 percent and is rising as drilling and production expand.

Figure 5. North Dakota Field Production of Crude Oil

Source: EIA Data with EPRINC additions using Continental Resources information and latest production data from North Dakota Pipeline Authority.

The Bakken is a continuous oil accumulation characterized by “sweet spots.” Not every well has a 2,000 b/d IP rate (although some have had rates as high as 4,000 b/d). Some companies may have less acreage but higher total production than others. The notable “sweet spots” in the Bakken are the Elm Coulee field in Montana and the Nesson Anticline and Billings Nose in North Dakota. These spots are deemed sweet because of their production rates, understood to be linked to natural fractures in the rock allowing oil to flow into the wellbore at higher rates than other parts of the Bakken. However, as more and more drilling activity takes place West of the Nesson Anticline and even in Montana, the risk associated with new acreage is shrinking. Sweet spots themselves are becoming less important as knowledge of the geology has grown.

Greater understanding of the rock as well as the application of technology is what led the first producers in the Bakken to success. But approaches to drilling in the Bakken are different from company to company. Some companies have longer horizontal well bores than others and use twice as many fracturing stages. Completion practices, such as what type of proppant, sand or ceramic, also vary from company to company and depend on geology. All of these elements taken together help increase the EUR (estimated ultimate recovery) of a well. The EUR is important given the price of drilling and completing a well and the rapid decline rates associated with shale oil wells.

In addition to understanding the rock formation and applying and adapting the right technological applications, producers must also overcome severe weather constraints in North Dakota. Temperatures commonly drop below -40o F and massive amounts of snow can be expected during winter. These weather constraints often cause producers to shut-in wells for a period of time until wells can be accessed and produced oil can be transported. The past few winters have been some of the worst in North Dakotan history and are proving to be very challenging for the industry. Additionally, severe spring rains have caused towns to be evacuated due to flooding.

Figure 6. Western North Dakota Flooding June 15th 2011

Source: EPRINC photo

Furthermore, the cost of drilling these wells has increased significantly over the past few years. Costs are likely to increase further as rising oil prices have triggered drilling activity in multiple shale plays throughout the US. While the cost can vary from company to company depending on a host of factors such as the length of the horizontal lateral, the number of frac stages, and the choice of proppant (sand or ceramic), the cost of drilling and completing an oil well in North Dakota in 2009, according North Dakota Petroleum Council, was $5.6 million. Today, several companies have reported drilling and completing costs of over $10 million per well. This increase is largely due to longer horizontal laterals and more frac stages, but also higher input costs from increased demand in rigs and completion services throughout the country and region.

Because of the rapid growth in drilling there is a constraint on well completion services and many companies face a backlog of wells that are awaiting completion. This means that the well is drilled, but may not yet be fracked and ready for production. The delay can come from weather related constraints as well as constraints in available frac crews. Only fifteen frac crews are now operating in the Bakken despite a rig count of 170 or so rigs.

As the demand for completions increase, so does the demand for water. Six billion gallons of fresh water are needed per year for hydraulic fracturing operations. Fresh water must be used to ensure clean and conducive fractures. Projects are currently underway to secure water supplies for arid rural communities and the oilfield. But this issue of water supply for both local communities and the oilfield will continually be dealt with and debated as drilling increases in the region.

Bakken production is sensitive to price swings, but advancing technology and growing support from oil service companies suggest that production can be sustained as long as wellhead values remain above $50/barrel. Bakken crude sells at a discount to LLS (Light Louisiana Sweet) and even WTI (West Texas Intermediate) despite its high quality as transportation costs remain high for shipment to refining centers and major consuming markets. However, new infrastructure developments may soon support higher well head values. Light sweet crude oil from the Bakken has a higher value at major refining centers because of its high quality; however, because North Dakota is so far from traditional oil transport centers, Bakken crude suffers a discount due to infrastructure constraints in transportation. North Dakota production went from 100,000 b/d to 350,000 b/d in four years. This dramatic growth was so rapid that it has not been matched by typical crude oil transportation such as pipelines. Bakken crude currently has the necessary take-away capacity with pipeline, rail, and truck included, but growth is needed to help keep price discounts from eroding wellhead values in the region (see figure 7).

Figure 7. Transportation System Capacity (including planned projects)

Source: North Dakota Pipeline Authority. Note: many projects are still in planning stages or have not yet been approved.

The price of Bakken crude can vary from company to company and is often dependent upon which market it can gain access to and through which mean of transportation. While rail has historically been more expensive than pipeline, Bakken crude discounts have been high enough to justify shipment by rail to markets as far as St. James, Louisiana which offer prices benchmarked to Brent/LLS. However, crude prices are not only important for producers, but for state treasuries as well. Kathy Stormbeck from the State Tax Department in North Dakota has noted that “every $1 increase or decrease in the price of oil impacts gross state revenue by $9.3 million a year.”

Implications for North Dakota: Growing State Coffers, Tax Revenue, Low Unemployment

North Dakota currently has the lowest unemployment rate in the Unites States at just 3.2 percent. Each rig brought into the state increases demand for rig hands and support services such as housing and food service. North Dakota is one of the few states now running a budget surplus instead of a deficit. According to the North Dakota Petroleum Council, crude oil taxes on production and extraction averaged 10.3 percent in 2010, bringing $749.5 million in state revenues. In addition, the industry spent $1.49 billion in taxable sales and purchases. Natural gas brought in over $10.1 million in extraction taxes in 2010. Revenue from oil and gas operations is disbursed broadly to support infrastructure, education, trust accounts, and local governments. State and local governments face a range of new requirements to support the surge in oil production, especially road repair and construction.

North Dakota unemployment is the lowest in the nation, but high wages from the oil and gas industry has systemic impacts. Wage inflation is beginning to take root as it is difficult for stores, shops, and restaurants to keep workers given the opportunities in the petroleum sector.

Figure 8. Unemployment Rate by State, May 2011

Source: Bureau of Labor Statistics

The entire range of services required to support the oil boom are in short supply. Hotels in petroleum producing regions of North Dakota are booked two to three years out and every apartment is rented. Make-shift housing such as campers and RVs are commonplace. Many oil companies operate their own “man camps” where employees eat and sleep while they are working. A challenge for the state is to address the requirements for expanded infrastructure and related services while at the same time address the financial risks of an economic downturn should the rising production prove unsustainable.

Bakken Success and Future Potential

North Dakota oil production currently accounts for six percent of domestic production and is largely responsible for reversing two decades of declining oil production. High oil prices coupled with an evolution of drilling technology and a greater understanding of the underlying geology (due in large part to improved seismic surveying) have enabled independent oil companies to rapidly increase Bakken production. It is no coincidence that several shale gas pioneers were among the early Bakken players, duplicating and tweaking technology and leasing land early in the boom. Clearly, the application of both the art and science of horizontal drilling technology, including longer horizontal lateral lengths and multiple fracs were built upon a knowledge base from the experiences in the discovery and production of shale gas. What is happening in the Bakken offers the potential for technology transfer to other basins in the U.S. and worldwide. The Bakken is a prolific and exciting shale oil play, and new plays on the horizon offer significant promise including the Eagle Ford, Niobrara, Utica, Tuscaloosa, and the Monterey. The technology of horizontal drilling and hydraulic fracturing is also seen in more conventional plays such as the Mississippi Lime play in Oklahoma.

Many questions and uncertainties exist about the future of shale oil, including its capacity to yield sustainable oil production since many shale plays experience high decline rates. North Dakota is embracing oil development and has thus far provided a regulatory environment that addresses genuine environmental concerns but also embraces the economic benefits of rising oil production. Several factors taken together help explain the success of Bakken development and reveal lessons to future shale oil development. Additionally, the lack of federal land in North Dakota and a regulatory environment for judicious permit processing have helped spur rapid Bakken development. The oil companies involved have shown a remarkable capability to deploy new drilling and completion techniques necessary to match the growing knowledge of the geology. Infrastructure, such as take-away capacity is still a concern. However, interest to expand said capacity among both railroads and pipeline companies suggest that take-away capacity constraints will be alleviated in the near future.

Appendix

1. Oilfield Activity EIA

*Field proximity may be incorrect on Ross and Stanley fields

*Field proximity may be incorrect on Ross and Stanley fields

2. Williston Basin Stratigraphic Column

Source: Sonnenberg. Hart Energy Bakken Playbook 2010. EPRINC Diagram