In recent months corn ethanol producers have faced a number of financial setbacks, including at least one highly visible bankruptcy. Although greater use of ethanol is mandated by federal law, the industry is suffering from over capacity, and struggling to compete in an environment of falling gasoline prices. Federal mandates requiring so-called obligated parties, i.e., refiners, blenders, and importers, to use larger volumes of ethanol in the gasoline pool over the next few years should help the ethanol industry recover, but this recovery will come at a cost, largely reflected in rising prices of gasoline and middle distillates and likely higher subsidies from federal and state governments.

EPRINC has previously examined the role of corn ethanol in the U.S. transportation fuels market. Ethanol has clearly contributed to reduced imports of petroleum into the U.S. market, yielding a reduction in imported crude and petroleum products of around 174,000 b/d between 2000 – 2008. However, the cost going forward of blending ever larger volumes of ethanol into the gasoline pool, as required by law, is likely to escalate markedly in the coming years, particularly as ethanol exceeds 10 percent of the gasoline pool, the so-called blend wall. The reason the cost of using ethanol escalates rapidly once it hits the blend wall requires an understanding of both the regulatory environment and some of the unique characteristics of ethanol.

The Blend Wall

As a transportation fuel, ethanol brings both positive and negative contributions to the production of transportation fuels. At approximately 2-4 percent of the gasoline pool ethanol is a valuable commodity because it directly contributes to improved octane performance and can play a key role in the production of reformulated gasoline, i.e., gasoline that has the appropriate characteristics to meet many local and regional environmental standards.

Once ethanol exceeds about 3-4 percent of the gasoline pool it must compete head to head with gasoline. However, as a substitute for gasoline ethanol is less valuable due to its lower energy content. In addition, concern over warranties and possible damage to smaller engines, U.S. regulations limit ethanol to 10 percent of the gasoline pool. Larger blend percentages are only appropriate for so-called flex fuel vehicles. Federal mandates for ethanol are a volumetric requirement, which means once the entire U.S. gasoline pool hits 10 percent ethanol blend, i.e., the so-called blend wall, additional mandated levels must be marketed as E-85.

What Happens When We Hit the Blend Wall?

As federal mandates take the U.S. gasoline pool above 10 percent ethanol blend, and ultimately to higher levels through E-85, the value of additional ethanol supplies is likely to decline dramatically and may do so even before the sector hits the 10 percent blend wall. However, obligated parties will still face a binding requirement to use ethanol regardless of its falling value.

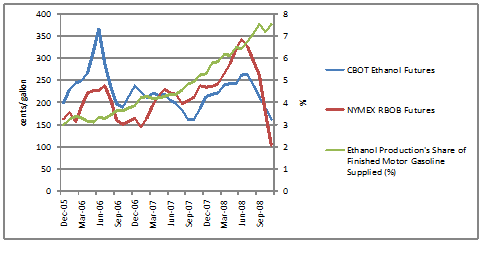

Fig. 1 shows front month futures prices for NYMEX New York Harbor RBOB and CBOT Ethanol on the left axis and ethanol’s share of the gasoline pool on the right axis. Ethanol prices have followed the declines in RBOB but at lower levels reflecting its lower BTU content. Because ethanol is not a petroleum product and cannot be commingled with the petroleum product pipeline system, it also comes with higher distribution and handling costs than conventional petroleum products.

Figure 1: Ethanol and RBOB Futures, Ethanol’s Share of Gasoline

Source: CME Group, EIA data, EPRINC Calculations

Aside from its lower energy content, ethanol faces another hurdle: its vulnerability to fluctuations in the price of not just one, but two feedstocks. In the absence of a federal mandate, ethanol must be able to compete with gasoline, which means its attractiveness as a competitor to gasoline declines when crude and gasoline prices decline. In addition, ethanol is not a petroleum product, it is made from corn, and its cost of production will not naturally adjust to shifts the value of crude oil, as is the case with petroleum products. Recent trends in the petroleum market demonstrate this problem clearly. Ignoring capital and distribution costs, the price of corn alone generates a cost basis for ethanol that currently exceeds the price for RBOB on the NYMEX.

Enter the RIN

A RIN (short for “renewable identification number”) is a 38-character code that represents a gallon (or often a batch) of ethanol and travels with that batch from the ethanol producer to the blender. When, and only when, the ethanol is blended into gasoline or E-85 can the RIN be removed from the batch. When removed it becomes proof that the blender met his obligated mandate for ethanol use. A blender that cannot meet its quota for the year could buy RINs from a blender who already has or expects to exceed the quota. These purchased RINs can be substituted for actual blending since they are only available from obligated parties that have exceeded their blending mandates.

EPA has recently set the blend requirement for ethanol in the U.S. gasoline pool at 10.21 percent for 2009. As ethanol approaches, and possibly exceeds the blend wall during 2009 we may see some additional discounting in ethanol at the pump to make sure obligated parties meet their mandates. RINs carried over from 2008, however, may be sufficient to permit obligated parties to hit the percentage requirement without substantial increases in E-85 sales. However, 2010 may see ethanol values fall substantially when the standard for renewable biofuels (ethanol) in the gasoline pool will increase from 10.5 billion gallons to 12 billion gallons, an increase of roughly 15 percent in ethanol use, and where most incremental volumes under the mandate will have to move through E-85 outlets. This is particularly the case if we remain in a period of little or limited growth in gasoline demand. Under the law, so-called obligated parties do not have a choice, they must adhere to the mandates even if it means taking a loss on ethanol in order to induce drivers to buy ever increasing volumes of E-85. These volumes are guaranteed through an allocation program that requires every obligated party to demonstrate they have met the mandate, and if not, they must purchase an allocation from those refiners who have exceeded their blend targets.

The Cost of Meeting the Mandate

As the volumetric mandates for ethanol use continue to grow over the next 2 years, obligated parties are likely to face a rapidly rising cost structure, particularly if the value of RBOB remains in the range of $1.00-$1.25/gallon. In this price environment ethanol production incentive programs, farm production subsidies, blenders credits, volumetric mandates, tariff protection, and related programs will all be inadequate to bring enough ethanol into the market at a low enough price to induce consumers to purchase the higher volumes required by law. Ultimately, consumers will not buy the mandated volumes unless the price difference is sufficient to make E-85 a better buy than E-10.

But in a low value RBOB market, the discount at the pump is only half the story. Blenders and refiners must pay ethanol producers enough (capital and operating costs) to sustain output at adequate volumes to meet the mandate and at the same time install adequate distribution capacity (E-85 pumps, additional storage capacity, etc) to move the mandated volumes into the market. With the RFS set to increase the minimum amount of “renewable biofuel” from 10.5 billion gallons in 2009 to 12 billion gallons in 2010, obligated parties will face rapidly rising costs in meeting the mandate. Essentially the mandate will play out as a shift in the cost of production for all obligated parties with a constraint that ethanol must be priced sufficiently below the price of E-10 to guarantee the mandated volumes move into the market.

Ethanol’s Contribution to Rising Fuel Costs in a Low Value RBOB World

As stated previously, the lower petroleum product prices now prevalent in the U.S. transportation fuels market are providing important relief to consumers from the high fuel prices prevalent throughout much of 2008. This lower price structure for petroleum products, however, is likely to be eroded as obligated parties move the mandated volumes of ethanol into the market in excess of the 10 percent blend wall.

But why would greater ethanol volumes lead to rising prices for E-10 and diesel fuel? The following example is illustrative. Currently, RBOB prices are in the range of $1.15 per gallon. Ethanol prices will eventually have to command approximately $2.00 gallon to cover capital and operating costs ($1.20/gallon for corn feedstock at current corn prices plus $0.76/gallon for capital and operating costs). Moving the required higher volumes of ethanol into the market will require new investments at retail facilities (new pumps, tanks, etc.) and E-85 will have to be discounted substantially below the price of E-10 to induce consumers to purchase sufficient volumes of ethanol to meet the mandate. Obligated parties will have a choice, if they can purchase RINs at a cost that is lower than the cost of marketing ethanol, this will be the preferred alternative. However, we can expect the value of RINs to quickly reflect the additional cost of moving the incremental volumes into the market, i.e., the cost of RINs and the cost of moving incremental volumes of ethanol into the market should be about the same.

While an obligated party can often capture a 45 cents per gallon blender’s credit, the obligated party must discount the ethanol sufficiently to overcome consumer resistance from lower MPG performance and more frequent stops to refuel. In most cases, such consumer resistance can only be overcome by lowering the price of E-85 relative to E-10 somewhere in the range of 30-40 percent. This means the value of ethanol to the obligated party is E-10 minus 30-40 percent, minus an estimated incremental distribution cost of 25-40 cents per gallon (cost recovery for storage, distribution, & E-85 pumps under low volume scenarios). As shown in Figure 2 below, when RBOB is selling for $1.15 per gallon, ethanol’s market value is somewhere between 30-45 cents per gallon (after crossing the blend wall), but its cost could exceed $2.00 gallon. Obligated parties can get some relief if they can recover the blender’s credit of 45 cents a gallon, but the large difference between the cost of ethanol and its value will remain even if wholesale gasoline prices rise by another 50 cents a gallon above current levels.

Figure 2: Value of Ethanol in the Gasoline Pool

* Operating and capital costs are for a new 50 million gallon ethanol plant with a yield of 3 gallons/bushel. Source: The Long-Run Impact of Corn-Based Ethanol on the Grain, Amani Elobeid, Simla Tokgoz, Dermot J. Haye, Bruce A. Babcock, and Chad E. Hart, Center for Agricultural and Rural Development, Iowa State University, November 2006

Conclusion

Ethanol has added to the U.S. fuel supply and reduced net petroleum imports. However, future contributions from ethanol to the transportation fuel supply may only be possible by moving up a very steep cost curve. These additional costs are likely to be distributed across the entire mix of fuels available at the pump, and will continue to increase as the mandate increases, and as long as we remain in a market with low wholesale gasoline prices. If wholesale gasoline prices had remained above $3.00/gallon with rising demand growth for transportation fuels, the ethanol volumes mandated by Congress could have been accommodated into the market at a relatively modest cost. However, we are now entering a period of low (or even negative) demand growth for transportation fuels, and more importantly, wholesale gasoline prices remain well below $1.50/gallon. In this market environment, accommodating increasing volumes of ethanol into the gasoline pool will likely require substantial increases in the price of E-10 and diesel fuels as refiners and marketers face the higher costs of meeting the mandate. The higher costs will come from lower utilization rates at U.S. refineries and higher distribution costs for ethanol. There are several scenarios where refiners will have to recover as much as $1.00 or more for every gallon of ethanol blended into the transportation fuel. This cost can only be recovered through higher prices for E-10 and distillate, and depending on a wide range of factors, could easily drive gasoline and distillate prices up by 10-25 cents/gallon over the next 2-3 years as compared to a scenario without the fuel mandates.