The two organizations have reached out to a wide range of experts, government officials, and market participants through a series of workshops. The initial workshop

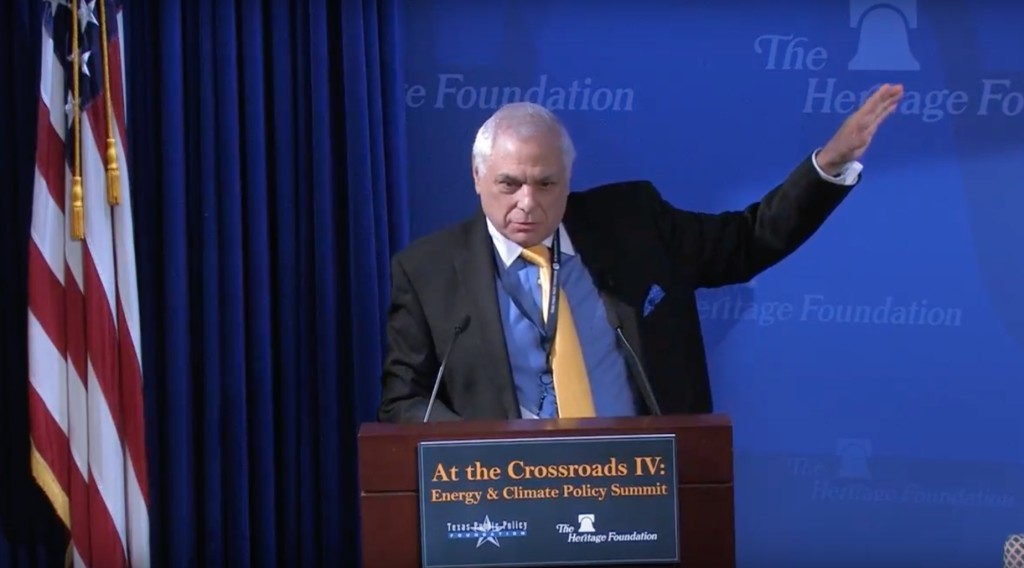

The event began with opening remarks by EPRINC President Lucian Pugliaresi and Canadian Political Minister Martin Loken. Both stressed the importance of a cohesive trade

© Energy Policy Research Foundation | 25 Massachusetts Ave NW, Suite 500P (Mailbox 14), Washington, DC 20001 | (202) 944-3339 (Phone) | (202) 364-5316 (fax) | info@eprinc.org

Design & Development by Red Clay Creative